Shopper Identification:

Fueling High-Growth Retail

Decoding how identification increases reach and moves more customers through the lifecycle

Every day, shoppers walk through your virtual door. They browse your pages, read product descriptions, and add items to their cart. Maybe they make a purchase, maybe they don’t. And then, they click away from your website — often forever.

Do you know who these shoppers are? Do you know how to bring them back?

For high-growth retailers, shopper identification is an essential tool for business expansion. It transforms unknown visitors into known prospects and shifts the marketing focus from channels to customer journeys.

With strong shopper identification, retailers can drive customer movement, using “signals” to spot shopper behavior and targeting customers with messages that matter to them. These signal-based strategies deliver a personalized and relevant experience for every shopper.

Say goodbye to the spray-and-pray approach many retailers rely on. Instead, meet shoppers with targeted, cost-effective campaigns. Retailers who adopt a customer-focused growth strategy benefit from:

- Improved Conversions. Targeted messaging drives stronger conversion rates and grows top line revenue. Plain and simple. Reach shoppers when they’re primed to purchase with messaging that speaks directly to their needs and wants.

- Long-Term Retention. Repeat purchases are the lifeblood of retail. With identification, you build meaningful relationships with your customers that keep them coming back year after year. Strong identification delivers a 4x to 12x increase in retention for the average retailer.

To grow and win in the market, retailers need to own their reach.

Reach refers to a retailer’s ability to message a shopper no matter where they are. Instead of waiting for shoppers to return to their site, high-growth retailers take a proactive approach. They expand their reach by (1) identifying shoppers as they enter the funnel, and (2) having permission for future engagement (email, text, etc.).

A dynamic identification and engagement strategy equips retailers to navigate tough market conditions, seasonality, regulatory changes, and other disruptions. It gives them the tools to fly through any storm their business encounters.

Retailers who can’t identify their shoppers are flying blind

Every day, they miss opportunities to identify, track, and engage potential customers. These retailers are left waiting and hoping shoppers come back to their site.

This looks like:

- Low identification rate. Identification rate refers to the percentage of site visitors a retailer can identify by an attribute, such as phone number or email address, and tie back to a customer profile. Retailers with low identification rates will struggle to reach more shoppers.

- Lack of visibility into behaviors. Shoppers exhibit five types of purchase-signaling behaviors — behavioral, product, lifecycle, identification, and transactional — throughout their buyer’s journey. Retailers who don’t identify these behaviors miss the opportunity to engage shoppers at key moments.

- Low website conversion rate. Relevance drives conversion. Unfortunately, instead of identification and targeted messaging, many retailers reach for a mass marketing approach to expand their reach. This drives traffic to the site but results in low conversion rates.

- Low engagement. When customers aren’t moved by messaging, they don’t engage. Customers may opt in, but over time they lose interest in the brand and shift their attention elsewhere. Emails wind up in the junk folder.

- Stagnant or shrinking email list. Despite marketing efforts, retailers struggle to grow their email list. Sign-up rates are low, and over time customers drift away from email communication and unsubscribe. They aren’t receiving the messages they need.

Strong environmental factors make reach even more complex. Third-party cookies are being phased out. Their usefulness will decline to zero over the next few years. Meanwhile, acquisition costs have increased exponentially, making it more expensive for companies to get in front of the same number of potential shoppers.

Retailers who continue to rely on outdated tactics will see their reach shrink — and their sales numbers along with it.

Understanding shopper identification

Shopper identification continues to be an often misunderstood or overlooked term for retailers. To clarify, let’s start by looking at the two types of identification retailers use to gain information on their everyday shoppers.

It’s important to distinguish between the two types of identification. Traditionally, retailers have relied on identity resolution, a method of reviewing past data (transactions) and combining disparate records into a household for a global view of the customer.

Identity resolution promises targeting efficiency but relies on historical and purchase data, excluding real-time, in-session data. As a result, you miss purchase intent and demand signals, limiting your relevance and likelihood of establishing an ongoing relationship.

Meanwhile, identity recognition is the ability to recognize a shopper by addressable identifiers and match them to previously collected behavior. This leads to retargeting and personalized communication based on preferences.

High-growth retailers are taking advantage of real-time data tools to meet customers along their buying journey. By doing so, they’re able to provide targeted messaging during moments that matter, driving engagement, conversions, and long-term retention. They’re also tapping into advanced analytics to predict a shopper’s future needs.

Shopper identification, then, is the process of recognizing each individual shopper by addressable identifiers and connecting them to their unique behaviors, preferences, and attributes. This process requires gathering and processing information on every visitor who hits your site.

How shopper identification is captured online

As third-party cookies are phased out, retailers need to leverage a full range of online data signals to unlock holistic shopper identification.

Sources of information include:

- Email and SMS Capture. Using online forms and interactions, retailers are able to collect email and SMS information. This information is added to the marketing database for future use.

- JavaScript Snippets and Purchase Pixels. Small pieces of JavaScript code are added to the retailer’s website to automatically track user behavior and conversions. This information helps the retailer better understand shopping patterns.

- Email Appends. Retailers overcome a missing email address by matching other information provided by the customer, including name and physical address. This helps round out the customer profile and increase engagement.

The power of a first-party identification network

An identification network is one of the most valuable resources a retailer can use to maintain and grow their reach — even as third-party cookies are phased out. That said, it’s important to understand the difference between networks and the best way to stay privacy compliant.

Today’s identification networks consist of various brands and publishers contributing data across devices, augmenting that data against a larger identification graph. This data-sharing approach enables retailers to cross-reference shopper information, fill in missing details, and deepen behavior recognition.

With access to a strong identification network, retailers:

-

-

- Increase identification rates. More shopper information increases the likelihood of identifying and analyzing visitor information. This leads to stronger identification rates across the retailer’s online footprint.

- Fill identification gaps missed by traditional methods. By tapping into a robust identification network, retailers expand their analytical capabilities and close information gaps. This leads to deeper customer profiles and better activity tracking.

- Reidentify shoppers across devices and after cookie-clearing. Traditional identification methods create blind spots — especially when shoppers switch devices or clear cookies. With a strong identification network, retailers can work around these common hurdles.

-

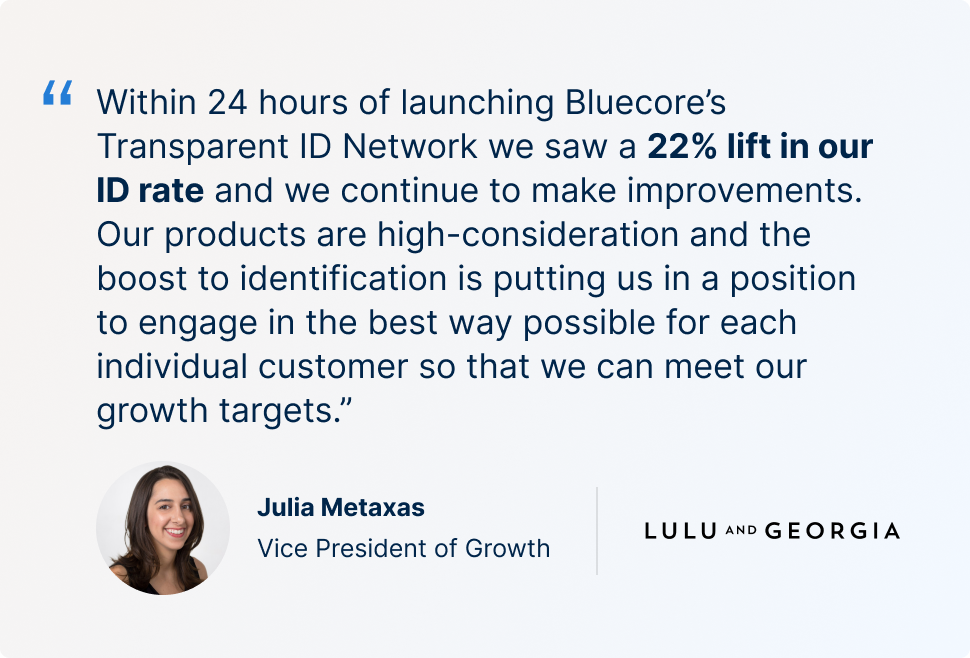

With more than 900 million email addresses and 10 billion daily events, Bluecore’s ID Network adds immediate revenue acceleration and long-term growth opportunities for enterprise retailers using first-party shopper data captured across top publishers and brand partners all connected to billions of consumer interactions.

Types of data used within identification networks

Pull back the curtain of an identification network, and you’ll see data. Lots of data. It’s helpful to distinguish between the types of information used and where it comes from.

First-party data refers to information generated by a retailer’s direct interactions with shoppers in their owned channels. Purchase history, website analytics, and customer account details are examples of first-party data generated every day.

In contrast, third-party data refers to information compiled by an external organization (the owners of the identification network or a data broker) and incorporated into the network. In addition to shopping information, third-party data may include demographic information, financial details, social media trends, and market research data that the network compiled about your shopper through their interactions on these external pages.

The most robust identification networks combine data sources together — first-party data from within the company, second-party data provided by other companies who contribute to the network, and third-party data from external organizations. By taking advantage of multiple data sources, this approach improves customer profiles and shopper identification.

How identification networks share data

To protect privacy, while still making full use of the power of first-party identification networks, providers use a combination of deterministic and probabilistic matching. Deterministic matching leverages direct data points to match shopper identification records with high accuracy, while probabilistic matching uses statistical models to determine the likelihood that data points belong to the same shopper.

From there, network providers take unique approaches to data sharing. The approach used by each provider tells you everything you need to know about the value they place on transparency and proprietary data within the network.

Approach 1: The Opaque Network

Many network providers keep the inner workings of their network under wraps. Once you’ve contributed your first-party data, the view becomes opaque. This lack of transparency makes it impossible, as a retailer, to know where your data is being used or how it’s being leveraged.

Additionally, these providers often engage in two-way data sharing, meaning your data can be used by any company that’s part of the network. As a result, your first-party data may benefit or inform direct competitors.

This approach serves the interests of the network provider — to profit from the combination and sales of data — at the expense of your proprietary, first-party data.

Approach 2: The Transparent Network

In contrast, other network providers offer full transparency. They inform every participant exactly where their data is being used and how it’s being leveraged. This means, as a retailer, you can keep full tabs on your proprietary data.

Additionally, these providers limit the network to one-way data sharing, meaning your data is siloed from other members of the network. With this approach, you can take full advantage of the data network without worrying about competitors benefitting from your contributed first-party data.

Because privacy is paramount, our robust identification network features unrivaled transparency and one-way data sharing. When you contribute to our network, your first-party data is siloed and protected.

Further, auditing, monitoring, and alerting are important measures for ensuring privacy and security as part of the Bluecore identification approach.

Shopper identification strategies

Today, the retail landscape is divided with companies using three strategies for customer identification. These strategies contribute directly to identification rates, customer acquisition costs, return buyers, and the bottom line.

Strategy 1: Traditional methods for reach

The first strategy is a starter approach to shopper data. Retailers who use this strategy — often by default — collect basic customer data, but do little to identify their online shoppers. They rely on generic metrics, such as location or basic demographic information, without leveraging real-time data and advanced analytics.

With this strategy, retailers:

- Have basic email capture in place. Using a standard form, retailers collect email addresses from site visitors. This approach is simple to set up and monitor but offers little shopper engagement.

- Don’t know or track their identification rate. Retailers don’t recognize the availability of shopper identification data. Or, if they do, they don’t track identification data points over time to drive improvements.

As a result, retailers are not able to see a holistic view of shopper interactions across their online footprint. They deliver an inconsistent customer experience and struggle to create a tailored buyer journey.

Further, without strong analytics and identification tools, retailers are unable to re-engage shoppers who leave their site. This drives acquisition costs skyward and eliminates the opportunity to engage shoppers at key moments.

Ultimately, this strategy is the least effective at driving engagement and generating repeat business. As a result, these retailers are vulnerable to the changing market conditions and the erosion of third-party cookies.

Strategy 2: The “spray-and-pray” approach to reach

The second strategy is a mass marketing approach. To drive traffic and improve their marketing database, retailers message an expansive audience across multiple acquisition channels. They rely on reaching as many potential customers as possible.

With this strategy, retailers:

- Capture marketing data (but it costs). Marketing campaigns are defined by broad, non-targeted messaging. Retailers grab attention and sales, but the underlying expense makes the business model feel unstable.

- Have limited identification and siloed triggers. Retailers continue to struggle identifying shoppers who hit their site. With limited ability to recognize buying signals, triggers are often misaligned and sales are missed.

As a result, conversion metrics and customer acquisition costs suffer at every stage of the marketing funnel. Shoppers walk in the door, and then leave just as quickly. And, with few options to re-engage them, the retailer is left having to invest in more marketing spend.

Further, with mass marketing, retailers run the risk of damaging their brand through poor personalization and misaligned messaging. At best, a spray-and-pray strategy often leads to high unsubscribe rates and one-time buyers.

Ultimately, this strategy may drive traffic, but it’s an inefficient way to get in front of shoppers. Often, retailers drive up their acquisition costs and damage their reputation in the process. In the long run, this strategy is unsustainable for most companies.

Strategy 3: Proactive identification to improve reach

The third strategy uses technology to identify shoppers in real time. Rather than waiting for shoppers to return or mass marketing to drive traffic, retailers take proactive steps to form a one-of-one relationship with each and every shopper.

With this strategy, retailers:

- Measure their identification rate. Retailers benchmark their identification rates and the impact current strategies and tactics have on shopper identification. This equips the marketing team with valuable signals they can use to engage shoppers.

- Enhance their identification rate. Using a reliable identification network, retailers work to improve their identification. They deploy proven tactics to capture online information and track shoppers throughout the buying process. Tactics include:

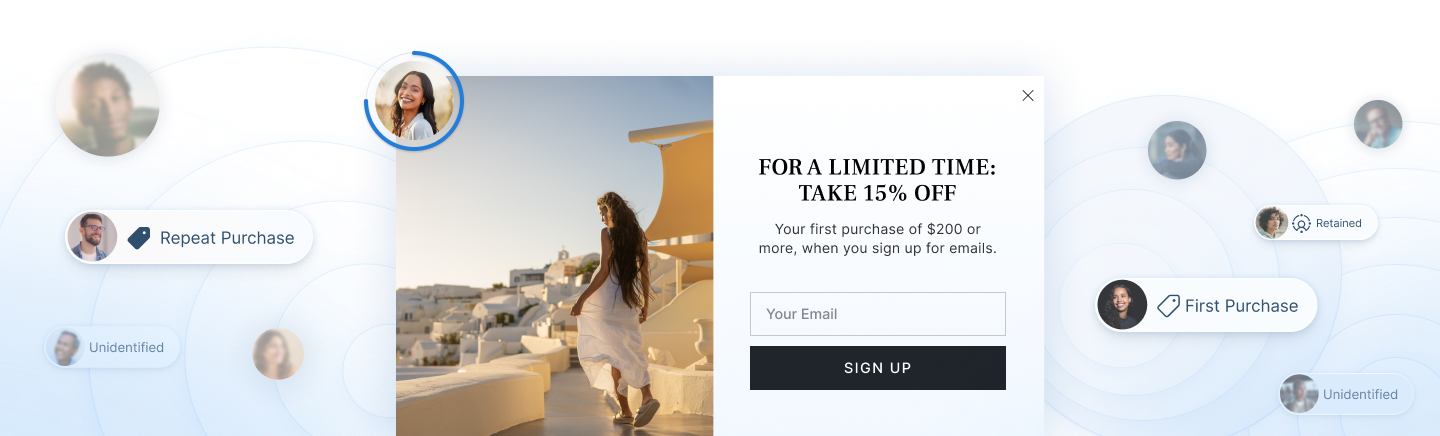

- Entry Capture. Retailers capture data as soon as a shopper enters the site. This is accomplished using pop-ups, forms, or interactive elements.

- Browse Abandon Capture. When customers browse the site, but then leave, they’re encouraged to revisit the site with follow-up emails or personalized display ads.

- Cart Abandon Capture. Similar to browse abandon capture, this tactic targets customers who have abandoned items in their cart.

- Notify Me Back in Stock. This feature allows shoppers to opt-in for email or SMS communications when a product is back in stock.

- Network Match. Retailers tap into an identification network to track shoppers across related websites or platforms.

- Email Appends. Using a third-party database, retailers add missing email addresses by matching known customer information.

- Monitor their identification rate. Retailers consistently key an eye on their identification rates, including the impact of new strategies and tactics. They deploy integration audits to ensure system connectivity and data accuracy.

Ultimately, this strategy gives the retailer an enhanced view of every shopper who walks in the door. With proactive identification, retailers can target shoppers with personalized messaging and meet them at critical moments along the buyer’s journey.

Benchmarking shopper identification rates

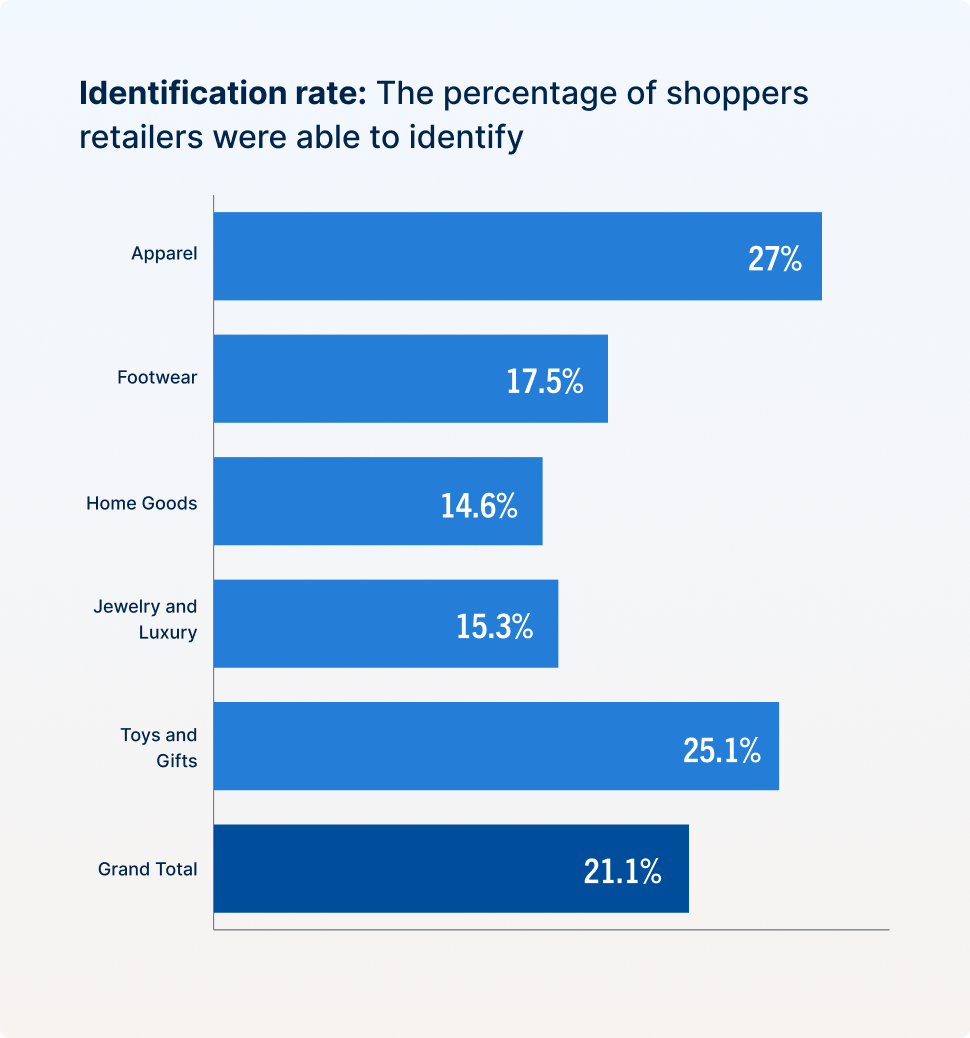

Identity rate is the primary benchmark during the acquisition stage. Because this metric sets customer movement in motion, it’s a major opportunity — and should be a major priority — for every retailer regardless of vertical.

To take full advantage of shopper identification, it’s important to consider identification rates. As mentioned, this rate refers to the ability of a retailer to tie website visitors to customer profiles using key attributes such as email address or phone number.

Step 1: Establish Your Identification Rate

Many retailers have not opened the hood of their marketing engine to analyze this data point. As a result, they don’t have a baseline for shopper identification. This makes it difficult to improve this metric and compare against industry benchmarks and key competitors.

High-growth retailers, meanwhile, establish and track identification rate alongside top-line metrics such as repeat business and retention rate.

In the next section, we’ll look at Bluecore’s proprietary Customer Movement Assessment, which we use to establish the identification rate for retail organizations.

Step 2: Benchmark Your Identification Rate

Once you’ve established an identification rate, turn to benchmarks to place your rate within a larger context. Here, there are two helpful comparison points. First, industry and competitor benchmarks place your identification rate within the context of similarly positioned companies. This tells you how you stack up against your direct competitors.

Additionally, benchmarking over time helps your company track improvement in shopper identification. Analyzing identification rate quarter-over-quarter gives you a snapshot view of the company’s forward progress in identifying and engaging shoppers at key points of contact.

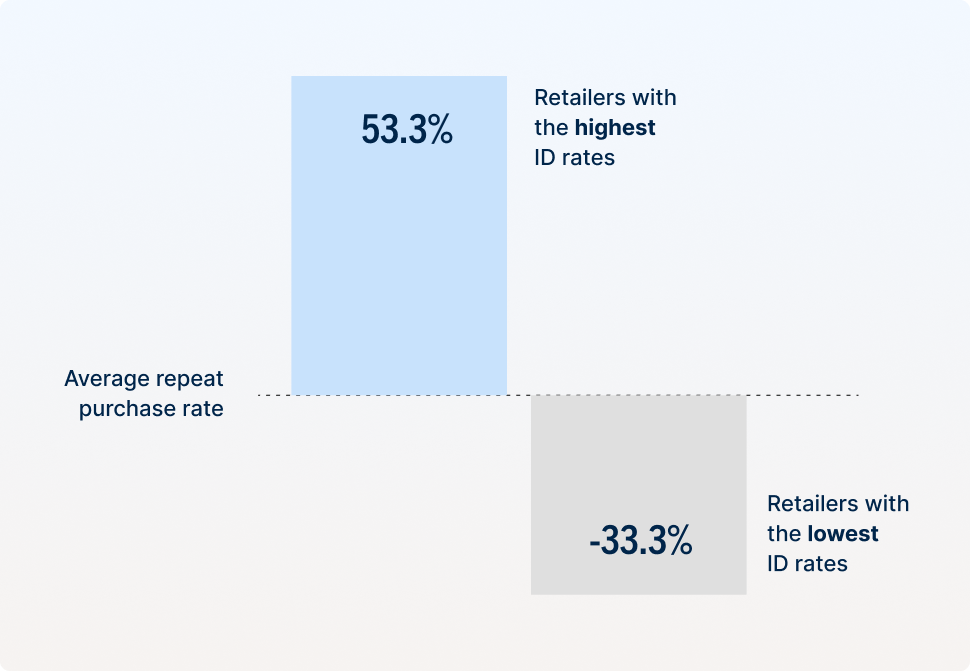

Further, analysis across Bluecore’s expansive database shows a direct correlation between identification rate and repeat business. The more a retailer improves their shopper identification, the more repeat purchase rates and three-year retention rates improve.

With strong shopper identification, retailers can achieve up to a 70%+ identification rate. This rate puts your company on par with the most advanced retailers in the market and positions you to capture a business-shaping amount of critical shopper moments.

Customer Movement Assessment

Bluecore data shows that retailers focused on channel-led growth see an average three-year customer retention rate of 22%. On the other hand, retail leaders who have embraced customer movement see an average three-year customer retention rate of 59%.

To help retailers unlock customer movement, we offer Bluecore’s proprietary Customer Movement Assessment, an industry-leading tool used to dive deep into a retailer’s shopper data, comparing it to our index of 200+companies.

The Customer Movement Assessment includes:

- Full customer file analysis

- Peer benchmarking for identification and retention

- Bottom-up trended forecast

- Campaigns to move customers through the funnel

Retailers who complete a Customer Movement Assessment walk away with a detailed strategy for achieving their growth priorities using the power of customer movement.

Conclusion

Market forces are working to drive down retail reach. Between rising acquisition costs and the phasing out of third-party cookies, many retailers will be left struggling to reach shoppers at key buying moments.

Thankfully, modern technology enables targeted identification. With a strong identification strategy backed by a robust identification network, retailers can unlock signal-based tactics, targeted campaigns, improved conversions, and long-term growth.