Addressing the Tech Blind Spots Holding Retailers Back

Do you have a technology blind spot? For most brands, the answer to this question is yes — whether they know it or not.

But as we enter a new era of email marketing and brands begin evaluating their relationship with their ESP, it’s critical to find and address these blind spots. Here’s what it takes.

Uncovering Disconnects in The Path to Purchase

To identify the technology blind spots holding retailers back, we first need to look at disconnects that exist in the path to purchase from the view of consumers, technology and the organization at large.

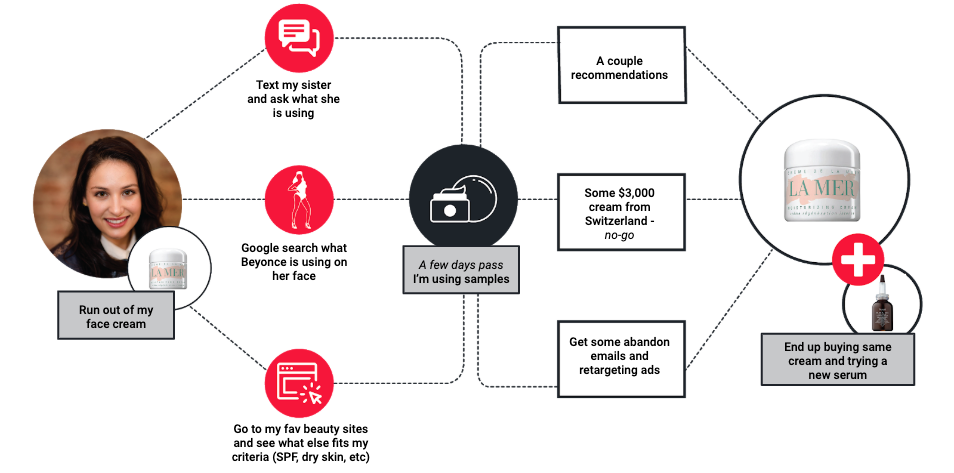

Path to Purchase: Consumer View

As consumers, our path to purchase is fairly straightforward. We might ask friends for recommendations, Google what our favorite celebrities use and research the pros and cons of options online. After all that, we likely end up with some recommendations from friends and brands before making a decision.

This path has three distinctive layers:

- Identity: All the ways you can identify a shopper (e.g. device ID, email address, cookies)

- Behavior: All the activities shoppers take during the purchase process (e.g. searching, browsing, abandoning, reviewing, rating)

- Product: All the products shoppers engage with based on their purchase criteria, plus the attributes of each product (e.g. drops in price, typical co-purchase trends, etc.) that heavily influence how products get marketed to shoppers

Path to Purchase: Technology View

As a marketer, you know what happens behind the scenes is not as simple. Unfortunately, these three layers within the path to purchase don’t interact seamlessly, and that’s because the technology most retailers use along the way have created bottlenecks. These bottlenecks include:

- Disconnected product catalog: When your product catalog is disconnected from your analytics system and your marketing channels, it’s nearly impossible to identify the right product for each shopper. With this disconnect, as new products arrive, older products get marked down and inventories change, you can’t use that information to surface recommendations based on unique shopper behaviors. At best you can recommend top sellers from last week that may or may not be relevant to each shopper.

- Latency between audiences and campaigns: It takes most brands 3-7 days to cut lists, upload audiences, complete creative and configure campaigns. Given that a shopper’s entire purchase cycle can happen within three days, that means your whole campaign is meaningless if you don’t capitalize on consumer intent immediately.

- Scaling personalization is impossible: Even if you had a real-time view of your product catalog and could immediately take action off the trinity of identity, behavior and catalog, you still need to activate personalized product recommendations through a channel like email. But scaling personalization proves difficult. To date, it’s been either (1) a manual effort or (2) limited to a small portion of your audience, as over 80% of personalization widgets default to static product recommendations.

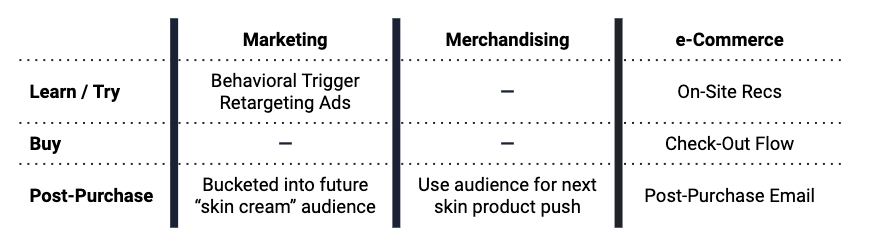

Path to Purchase: Organizational View

Finally, one more complexity sits atop all of these systems: The organizational view, which creates an even starker division between the data and tools as marketing, merchandising and ecommerce teams all look to dip into the data pool to drive sometimes conflicting objectives.

Introducing the Retention Death Spiral

This whole cycle has created a “Retention Death Spiral” (a close relative to the Email Death Spiral), which goes something like this:

- Brands see a decline in repeat purchases

- This decline gets compounded by a much longer purchase path

- The previous two issues force brands into a perpetual promotion cycle

- Once brands get locked into the promotion cycle, marketing and merchandising are at odds as they try to acquire, cross-sell and upsell customers while maintaining margins

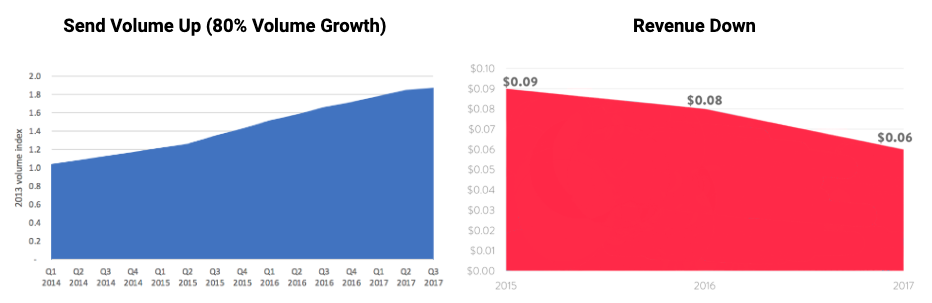

So how do you combat this Retention Death Spiral? The only levers brands have are to send more emails and to buy more ads. But as send volume and ad impressions have climbed over the past few years, revenue per email and return on ad spend have declined.

Getting Past the Retention Death Spiral with Technology Purpose-Built for Retail, Personalization and Scale

What’s the alternative? Is there a way to get past the Retention Death Spiral and eliminate these technology blind spots?

Yes, but it requires a transformation in technology to help increase performance with less effort. What you need is technology purpose-built for retail, personalization and scale. Here are three of the most important criteria:

1) Generic vs. Retail Data Model

Cheap Thrill

Typically, brands have data stored across multiple systems — those to manage identity, audience segmentation, product recommendations, execution and ecommerce. We’ve all heard about the emergence of CDPs, which are meant to become the new upstream data tools because existing technologies can’t manage anonymous and known identifiers together, but even CDPs focus only on identity and behavior and miss the product data necessary to create a personalized shopping experience.

Real Deal

The real deal here is a retail-specific data model that unifies behavior, customer and product data (note: tying in product data is the only way to surface relevant recommendations for each shopper). This setup doesn’t require the digital transformation so many brands are currently RFPing for. Rather, it requires the ability to combine the most predictive elements from your ecommerce platform and your store.

2) Manual vs. Autonomous Personalization

Cheap Thrill

You shouldn’t have to settle for manual workflows. The technologies built 10-15 years ago were only built for automation, basically making repetitive tasks faster, but not more intelligent or autonomous. As a result, a majority of your team’s time gets spent cutting and uploading lists, creating and managing segmentation (which is not personalization), manually optimizing campaigns and managing projects across multiple teams.

Real Deal

Modern technology changes this. Introducing the right technology can take your product catalog, creative assets and offers and use those inputs to generate a fully 1:1 and self-learning campaign that figures out the right products, content and offers for each individual. Notably, it will improve over time, learning based on consumer engagement, browsing and purchasing to optimize the product, content and offer recommendations for the next send.

3) Volume vs. Performance Model

Cheap Thrill

Finally, consider what the technology you use optimizes against. Most ESPs charge based on send volume and number of campaigns. That means their entire business is built on charging you to send more, regardless of outcomes.

Real Deal

Going forward, you need a solution that can optimize against performance and only charge you when it performs. This model will align your goals with those of your technology partner and push you both to prioritize email performance.

Eliminate Your Tech Blind Spots

At the end of the day, it’s all about driving more performance with less effort. The typical blind spots to avoid when re-evaluating your tech stack center around business outcomes. You need to ask:

- Does this system optimize against business goals?

- Does this system have the ability to bring in our product catalog in real-time to create the right retail data model?

- Can we use this system without having to double our team size to deliver on the performance claims?

The answers to all of these questions must be yes.

What does it take to introduce this type of solution? Check out our Ultimate Guide to ESP Selection for the Modern Retail Marketer to find out everything you need to know.