Performance-Based Email Marketing: Benchmarks & Strategies for Retail

How is your email program performing?

Email marketers face this question every day. In response, most retailers turn to straightforward email benchmarks like send volume, open and click rates and overall email ROI.

While these benchmarks are important to track campaign-to-campaign health and trends (especially for frontline email marketers) and can correlate to overall program performance, they don’t tell the whole story. They look at performance from a predominantly technical perspective, and technical problems require technical solutions. For example, to improve inbox placement rates, focus on email deliverability. To increase open rates, try A/B testing. To increase click rates, personalize more.

But after completing all those technical, under-the-hood optimizations, the question of email program performance still lingers. Too often, marketing leaders are left wondering: Our email metrics improved, so why is our revenue flat? And due to this “disappointing” outcome, they decide to slash the email program budget.

Performance-based marketing isn’t a collection of metrics, however. To understand the most important elements of a performance-based email marketing strategy, keep reading.

What is Performance-Based Marketing?

Performance-based marketing defines a successful marketing campaign by its ability to achieve a specific desired outcome. For example, instead of valuing email marketing campaigns based on metrics like open or click rates, marketers may track an overall growth in sales attributed to the campaign. This helps retail marketers measure their email performance in a way that is directly connected to key business goals.

Why Marketing Metrics Don’t Tell the Full Story of Email Marketing Performance

Traditionally, we have seen a huge disconnect between how retail email marketing budgets get decided and how the programs get executed. While budget decision-makers strictly look at revenue metrics, program managers generally optimize for email metrics like opens and clicks.

But as marketing and ecommerce teams consolidate, there’s a push to think differently about “email performance” by moving past the notion that a few disparate, promising signals will magically help achieve traffic, revenue and margin goals.

Instead, the fastest-growing brands recognize that “high performance” isn’t about acing every single metric — it’s about optimizing across the board for a very specific outcome. Achieving each potential outcome requires a unique combination of efforts, and those efforts depend on both internal and external circumstances. For instance, if you are optimizing for first purchases, you may employ a discount strategy. But if you are optimizing for cart size, you may focus on merchandising co-purchases or higher priced products to your repeat shoppers.

Consider the case of a football game. It’s easy to say that the quarterback with the highest passing yards will win, but that’s not a guarantee of anything. There are other dynamics that go into a win, such as skills and dynamics of the entire team and strengths of the opposing team.

The performance of an email marketing program is no different than the performance of a football team. In the retail world, factors like seasonality and products featured matter just as much as audience and timing when optimizing emails to achieve certain goals. Critically, the combination of measures that factor into performance and the level of importance for each will differ based on the outcome for which you’re optimizing.

3 Concepts to Advance a Performance-Based Email Marketing Strategy

To understand the true impact of a shopper first email marketing program, you need to cut through the noisy performance proxies that exist today. Doing so requires anchoring your metrics around three core concepts:

1) Economic Value

Your email marketing program exists to help grow your business. As a result, you should treat it like an investment vehicle and track revenue metrics that measure its return on key business goals. Everything else is secondary for two reasons:

- “Industry standard” email metrics imply one-size-fits-all, but financial goals don’t fit that mold. I have personally seen retailers with below average open and click rates coming from above average send volumes still manage to deliver an unprecedented amount of year-over-year revenue growth. While some might condemn low click rates, these retailers recognized that their email programs were uniquely serving their business needs.

- Tallying up dollars earned in a given timeframe is a scorecard for how you’ve done so far. But if email is a channel to increase revenue (spoiler: it is), you would be remiss not to have metrics that help you gauge the future economic value of your email program. And this economic value shouldn’t be a hard number for the entire year. Rather, you should take a cost vs. reward mindset in which you regularly re-invest your returns back into the email program. With this model, the more you put in, the more you’ll get back. As a result, capping your investment based on a number selected at the beginning of the year (as opposed to regularly revisiting your investment based on real-time returns) will only serve to limit the overall economic value of your email program.

Ultimately, when you consider email program performance, everything should come back to economic value. As you evaluate data, ask yourself: Does this metric say anything about the overall revenue direction and sustainability of the program or am I making an assumption? One metric to evaluate to get to the heart of this question is your annualized attributed revenue growth percentage using month-over-month data. The next two concepts will help unpack the rationale behind this metric.

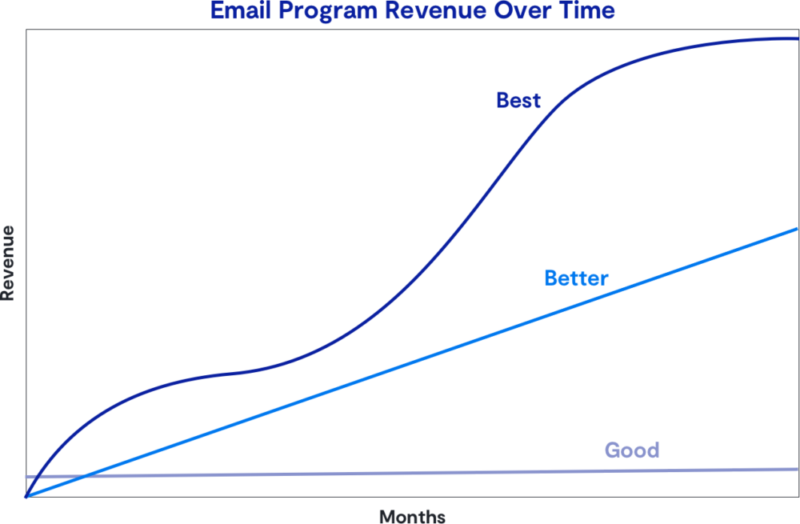

2) Growth

Being ROI positive should be a baseline, not a goal. Even if you are ROI positive, if your email program delivers the same amount of revenue month over month, that’s not true growth. Growing revenue, especially in a non-linear way, is the gold standard of shopper first email performance because:

- Non-linear revenue growth is a genuine reflection that your overall business is growing. It demonstrates that you are attracting new customers, getting existing customers to purchase more frequently and/or increasing average order values. It’s a strong signal that you are growing customer stickiness, reflecting increased customer loyalty.

- It also reflects that every resource (time, money, people) you devote to email marketing in a given month is a stepping stone for the next month’s performance. This type of compounding growth is important because it means that you’re not only devoting fewer resources to achieve more, but also that your email marketing strategy is getting more mature and intelligent. At the end of the day, email performance is part technology and part human knowledge of what works for your business, and non-linear revenue growth is proof that both of those elements are advancing.

3) Long Term View

Finally, the first two concepts won’t work without a long term view. You can have explosive performance in the short term, but the true hallmark of a high performing email program is sustained growth over a long period of time. This long term view is essential for reasons such as:

- Email programs require human input. The right retail marketing technology is essential to email marketing success, but even the most modern solutions require a human at the helm to set goals and provide feedback. Along the way, marketing teams need time to ramp up new colleagues, adjust campaign strategies throughout the year and take the time to collect data that can help improve emails. There’s no way to get around these human risks other than getting smarter about how human elements affect your business over time.

- There will always be external factors like seasonality and market trends that impact performance from one month to the next or one year to the next. For example, it’s completely normal for performance to dip in January compared to November and December. Even then, you might have generated more revenue last holiday season compared to this one. But before you jump to the conclusion that your program isn’t “performing,” consider the economic climate, any internal shifts in your company and the presence of other big picture detractors.

While it’s true that excellent performance withstands the test of time, it doesn’t mean you should wait five years to measure your email program. It simply means that if you have a clear economic goal and understand your growth trends in pursuit of that goal, you won’t take every minor setback along the way as proof that your email program is not performing.

Key Benchmarks to Help Guide Your Performance-Based Email Marketing Strategy

Now that we’ve established that email metrics shouldn’t be measured in a vacuum, we’d be remiss if we didn’t show you a real-world example of why that is. Let’s examine how a single metric – revenue per email – can vary depending on specific factors.

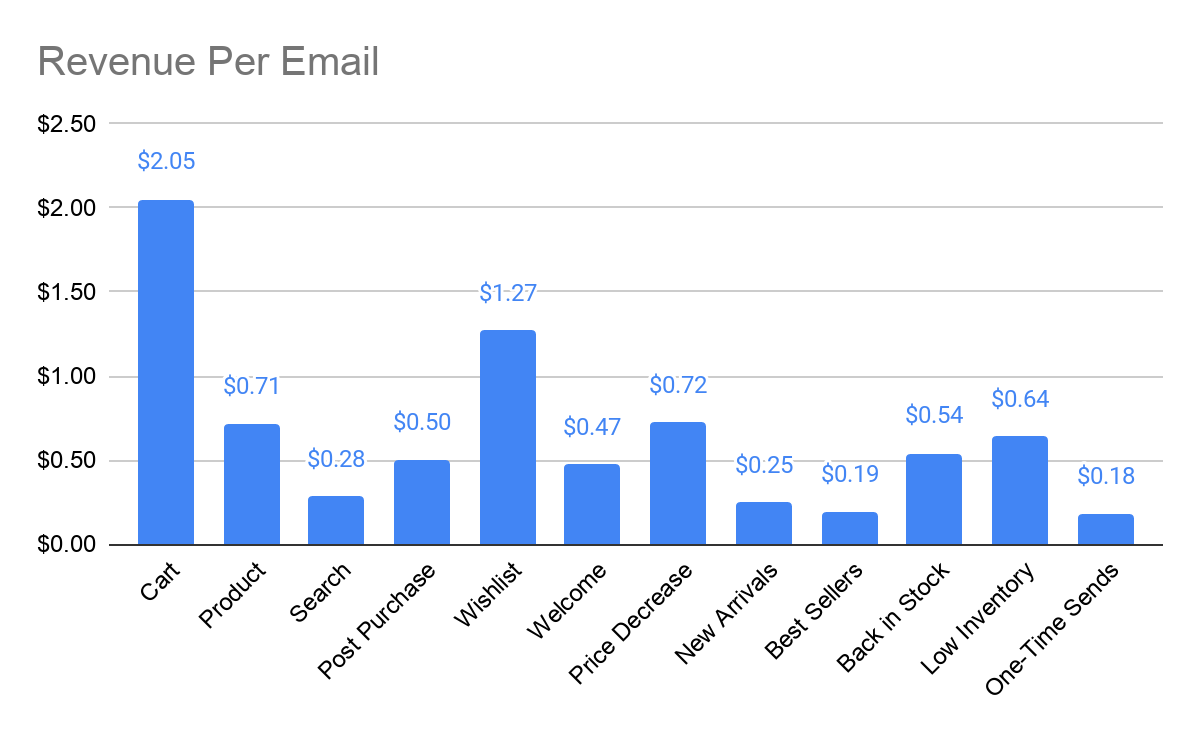

Let’s start with a simple one: Average revenue per email, broken down by email type.

In the chart above, we can see that cart abandonment and wishlist reminder emails drove the most revenue per email, while one-time sends and best seller emails drove the least. This paints a perfect picture of why context is important in any email campaign that truly puts the shopper first. It’s important to use many types of trigger emails to ensure customers remain active buyers – otherwise, you’ll never have the opportunity to send them an abandoned cart email!

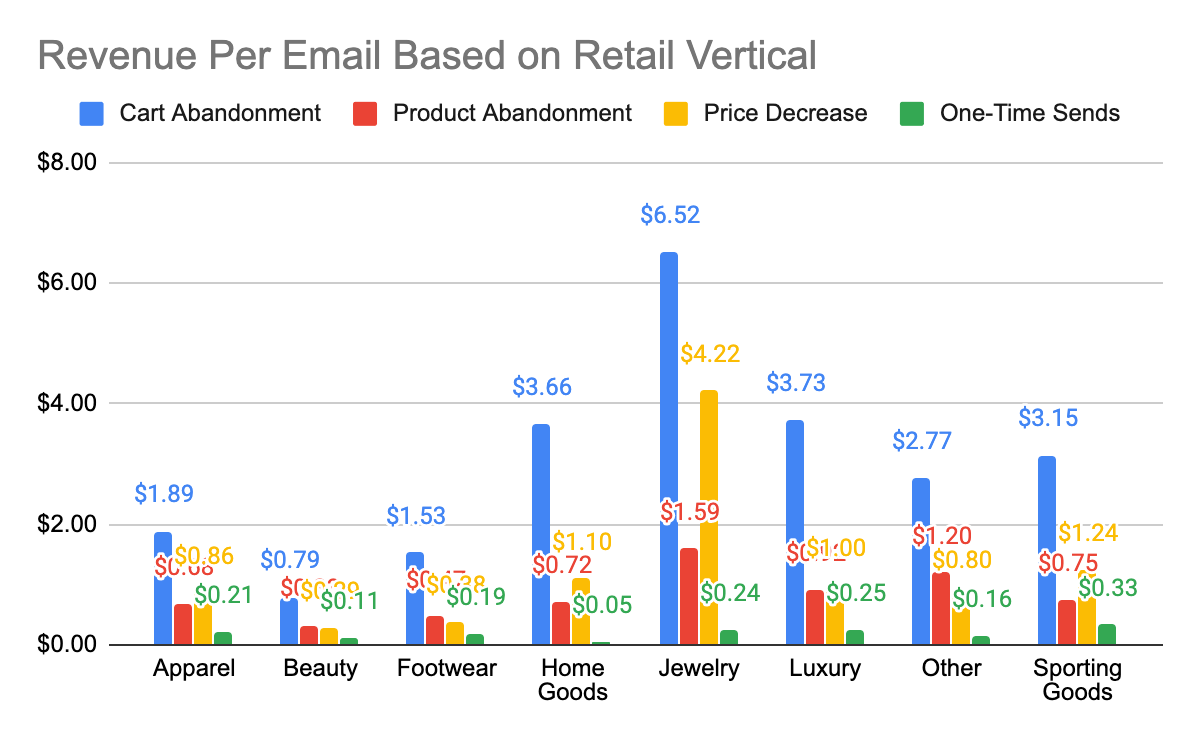

Next, let’s take a look at revenue per email, broken down by retail vertical.

Breaking down revenue based on a retailer’s vertical paints an interesting picture. We can see that cart abandonment emails continue to command the lion’s share of revenue, while product abandonment and price decrease emails are more or less tied for second place. So, keep in mind that depending on which product category you promote, your revenue per email could vary drastically.

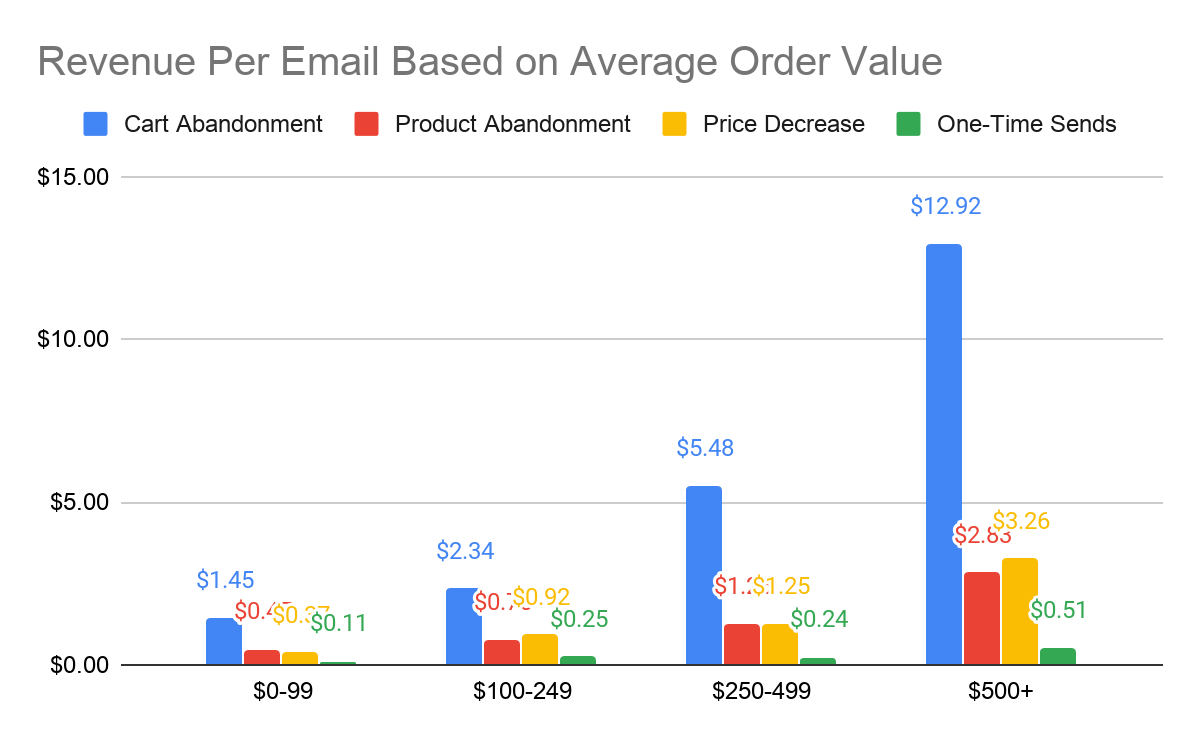

However, there are even more factors that could impact a metric as simple as revenue per email. Take a look at this graph:

The findings of this chart are fairly intuitive, but often overlooked. If you target email campaigns for customers that usually place large orders, you’ll enjoy a higher revenue per email than if you targeted customers with smaller orders. In practice, this means that optimizing for revenue per email incentivizes retailers to focus on a relatively small audience segment.

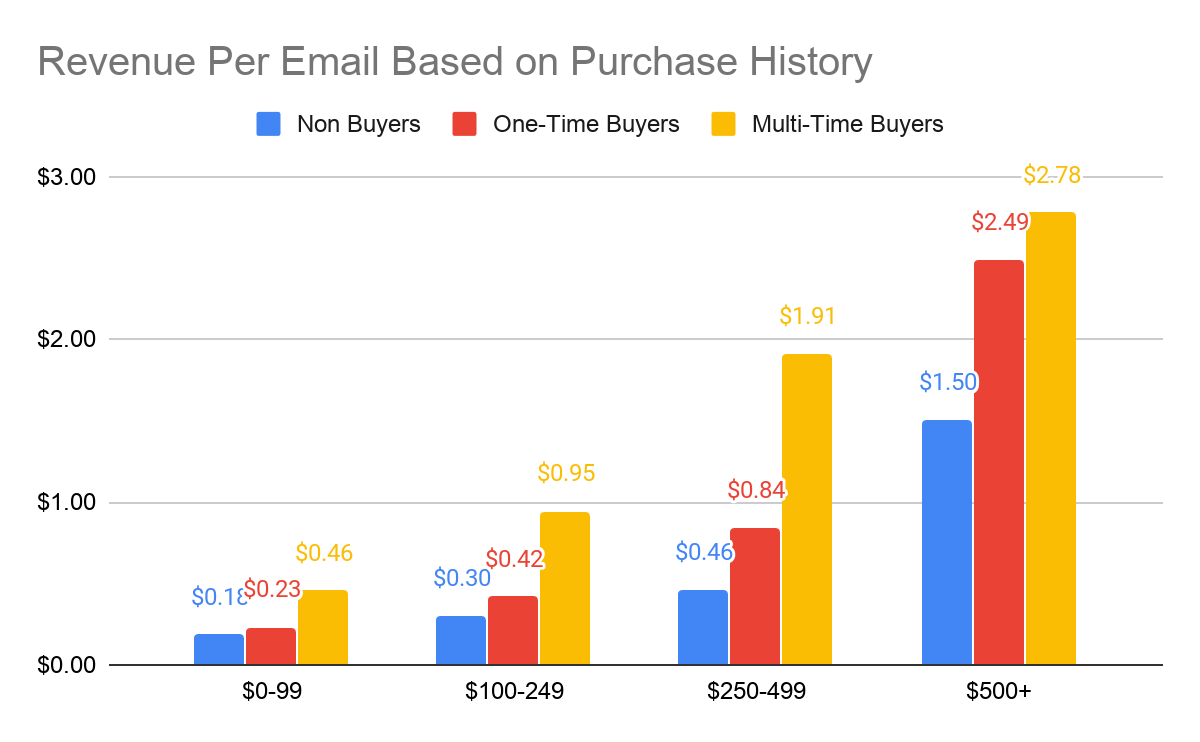

The last set of benchmarks we’ll evaluate is revenue per email based on a customer’s purchase history.

This graphic evaluates the difference in revenue per email based on lifecycle stage, broken down by their average cart size. The customers with the highest revenue per email are multi-time buyers, while people who haven’t made a purchase yet have the lowest revenue per email.

Now, let’s tie this all together. Imagine you’re in charge of a department store’s email marketing strategy. If you were to set a goal to improve revenue per email, what might happen?

Based on the data provided here, you’d likely end up sending a massive number of abandoned cart emails, and limit your one-time sends. Then, you’d likely focus on promoting a few key categories – likely jewelry, home goods, and luxury items, as they represent the bulk of per-send revenue. Finally, you’d limit your campaigns to customers with the highest average order value and try to focus on existing customers.

If that doesn’t sound like a solid long term strategy, then you understand why email marketing metrics aren’t the heart of truly shopper first performance marketing.

How is Your Email Program Performing?

Just like how a business plans for long term strategic health, it’s important to plan for the long term success of your email program. That planning starts with rethinking the way you measure email performance.

Economic value, growth and taking a long term view are three concepts you can use to get to the heart of the question “how is our email program performing?” Along the way, remember that you should not cap the economic value of your email program based on a predetermined number, nor should you be satisfied with flat performance (even if your program is ROI positive). And one minor setback does not mean your whole program is about to spiral downward — it’s about looking at the bigger picture.

With all of that in mind, how is your email program performing?