How Shoppers at Each Lifecycle Stage Engage Differently

What’s the difference between a shopper who buys from you regularly and a shopper who receives your emails but has yet to make a purchase? How about an active shopper versus one who’s strayed from her typical buying cycle?

These are questions every retail marketing team needs to ask — and answer — to maintain a healthy customer base.

Recapping the Importance of Customer Lifecycle Marketing

In our retailer’s guide to customer lifecycle marketing, we reviewed the importance of engaging with shoppers differently based on where they fall in the customer lifecycle and shared tips for how to do so.

To recap, we can define those lifecycle stages as follows:

To get started with customer lifecycle marketing, you first need to determine the distribution of your customers across these stages. Then you can use that information to market to each group differently. For example, you might use behavioral triggers to retain and increase loyalty among active buyers, merchandising triggers to re-engage at-risk and lost customers and personalized batch sends to bring non buyers into the fold.

Audience-Based Benchmarks: Measuring Email Engagement Across the Customer Lifecycle

Knowing that customer lifecycle marketing is important and adjusting your marketing strategy accordingly is one thing. Measuring the success of those efforts is another. So how do you know if your customer lifecycle marketing efforts are successful?

Much like we can expect shoppers to engage differently based on their purchase history and average order value, we can also expect shoppers to engage differently based on their lifecycle stage. Let’s take a look at what to expect from each group of shoppers once you start communicating with them differently.

Benchmarking Email Engagement by Lifecycle Stage and Retail Vertical

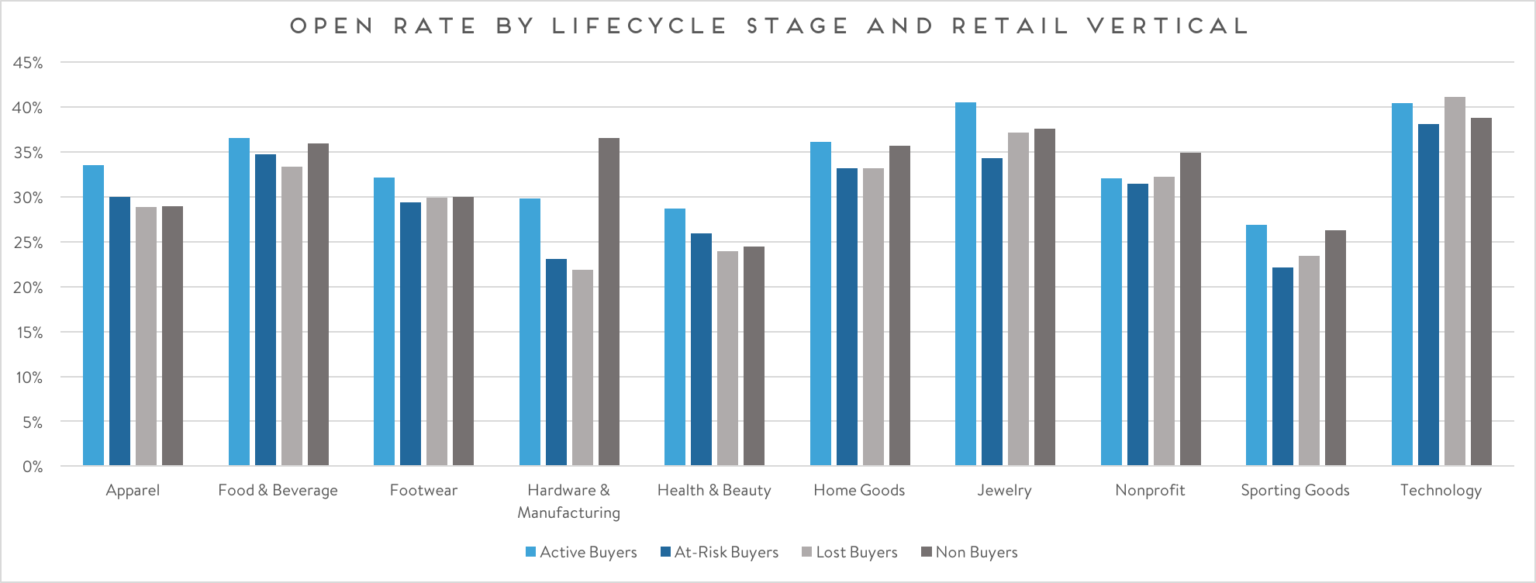

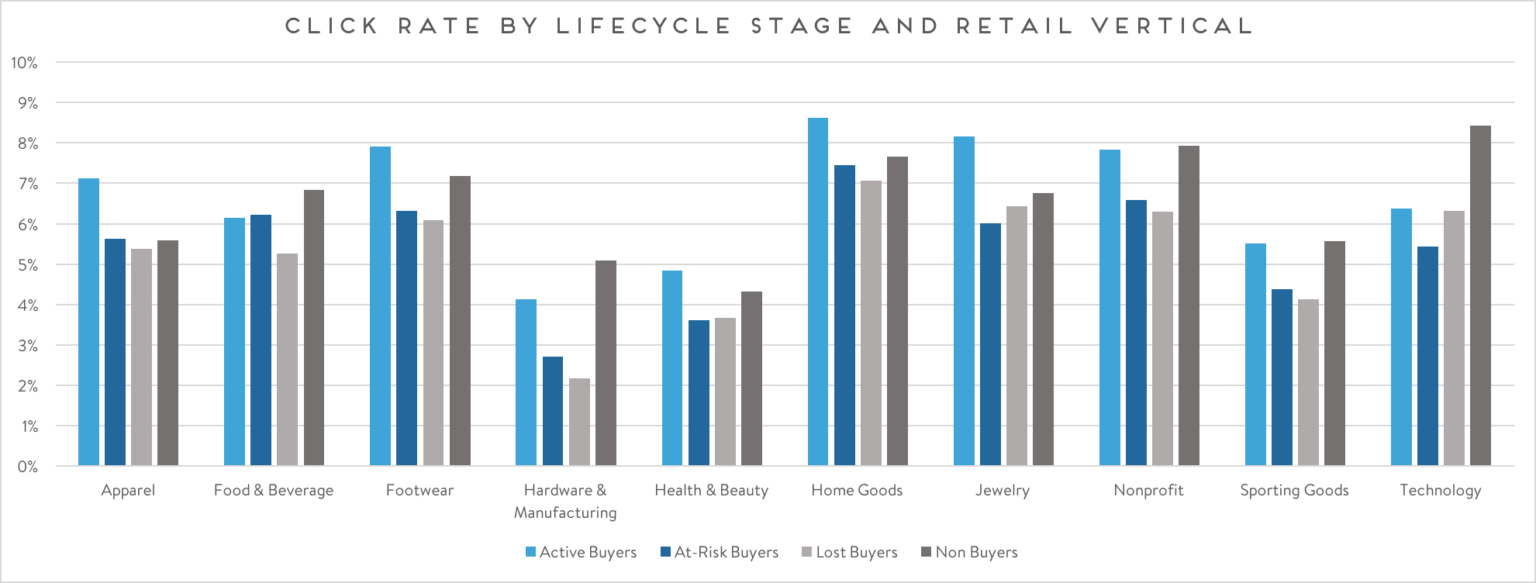

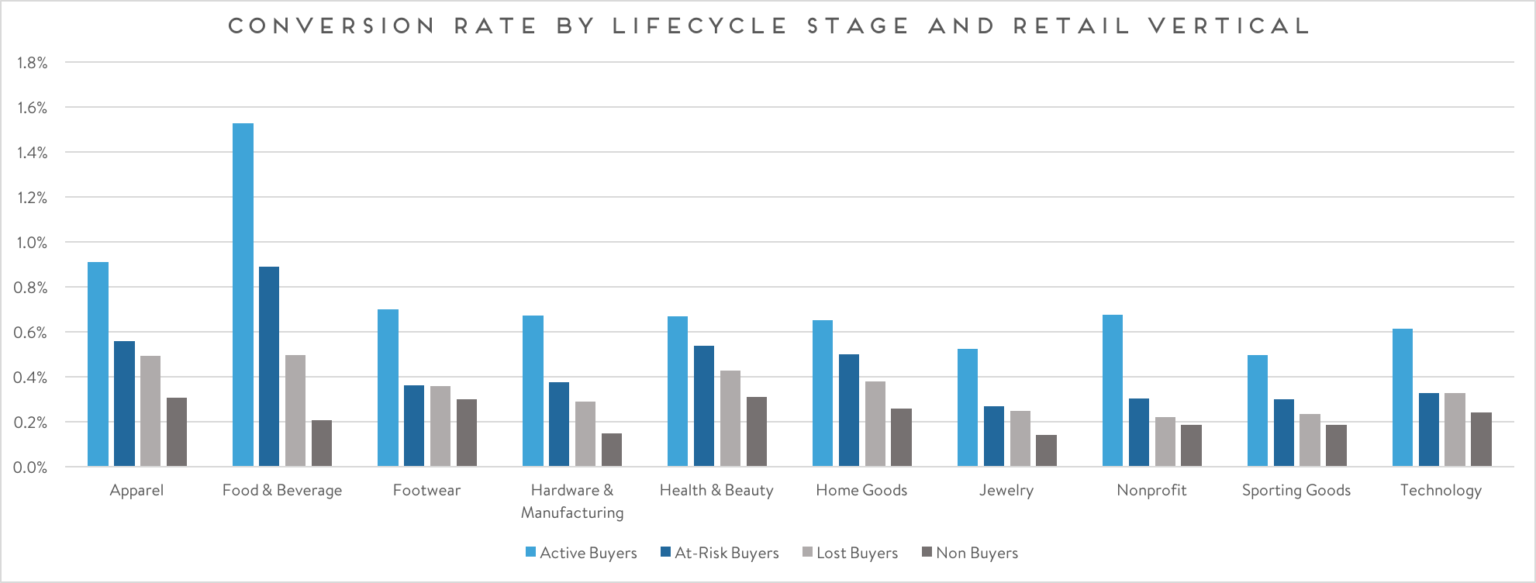

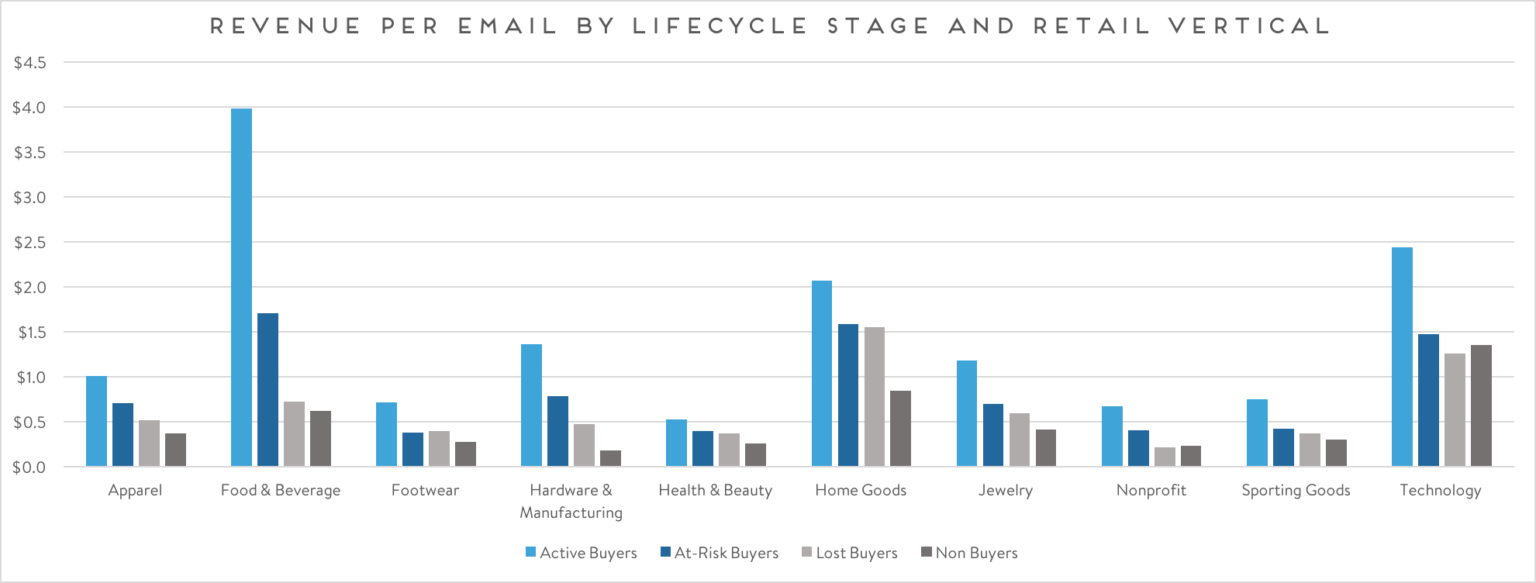

At the retail vertical level, open and click rates vary across lifecycle stages.

For example, verticals like food & beverage, hardware & manufacturing and home goods see the highest open rates from active and non buyers and also see the highest click rates from active and non buyers. However, footwear, health & beauty and technology retailers buck this trend, with non buyers opening at fairly similar rates compared to the other groups but clicking at much higher rates.

In general, we see high engagement rates from non buyers when it comes to opens and clicks. This supports our previous finding when examining how non, one-time and multi-time buyers engage differently. We can likely attribute this high engagement to non buyers who are in browsing mode and heavily considering their first purchase.

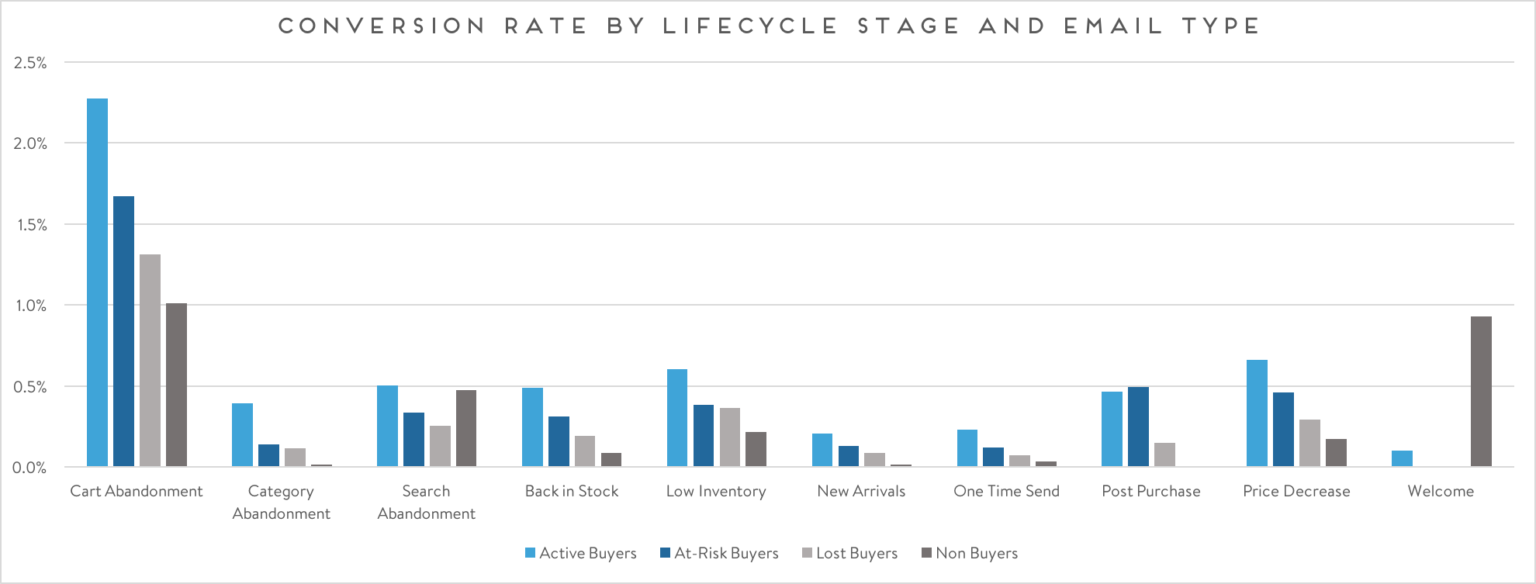

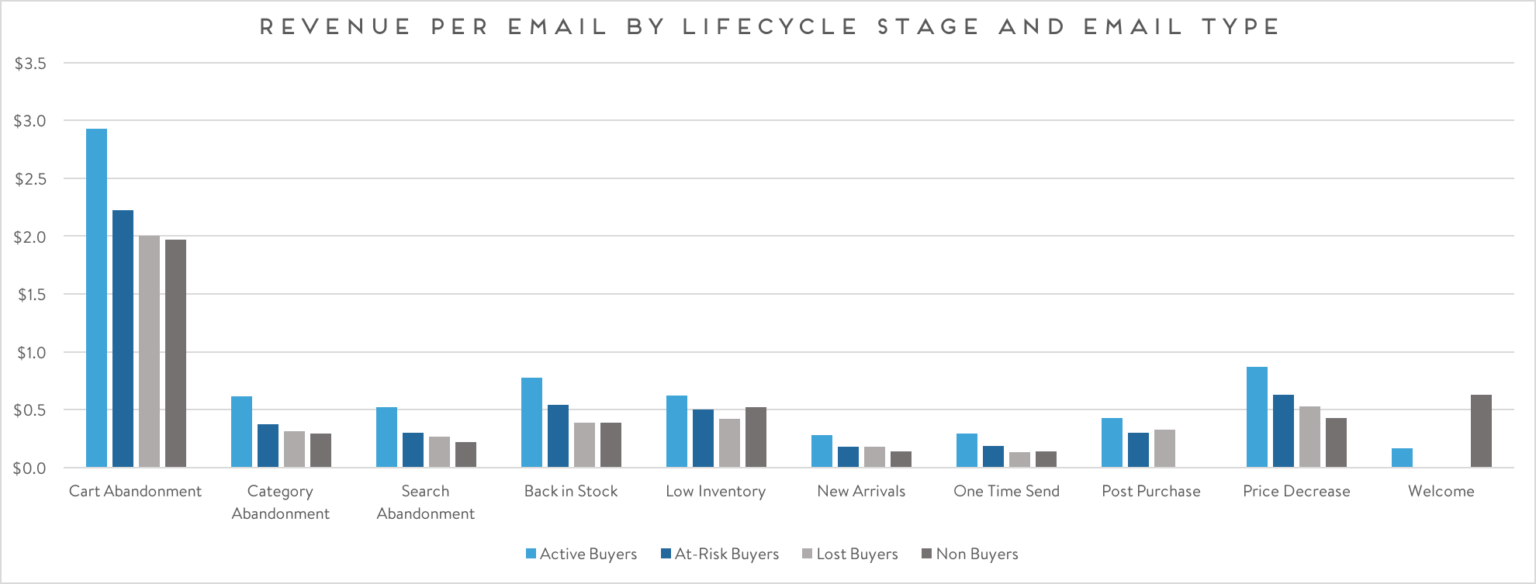

Although non buyers show a high propensity to open and click through emails, that’s where the high level of engagement ends. Looking at conversion rates and revenue per email, we see a different story. Not surprisingly, active buyers convert the most and spend the most when they do convert, followed by at-risk buyers.

Interestingly, lost buyers convert at higher rates and bring in a higher revenue per email than non buyers. This data indicates that it’s easier to win back lost buyers than it is to drive a first purchase from non buyers, even though those non buyers are more likely to open and click through emails.

Together, these findings provide a strong argument to develop strategic reactivation campaigns for lost buyers and suggest that it would be valuable to take a closer look at how you engage, nurture and convert non buyers.

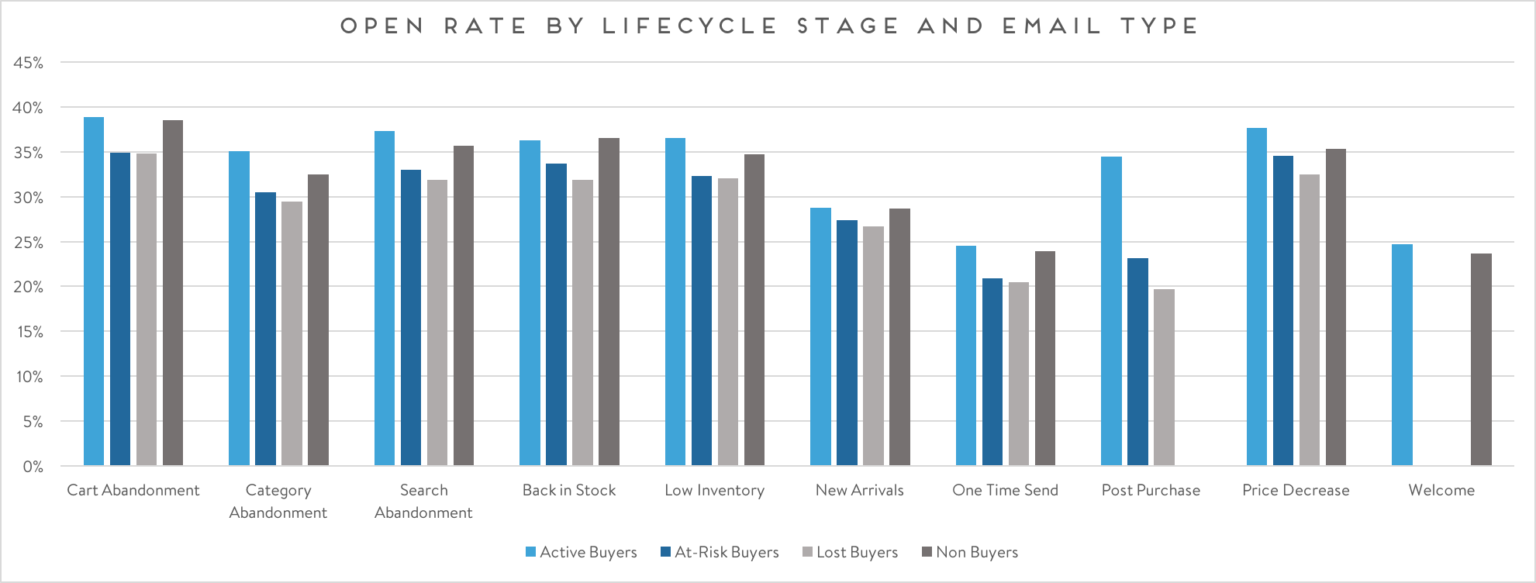

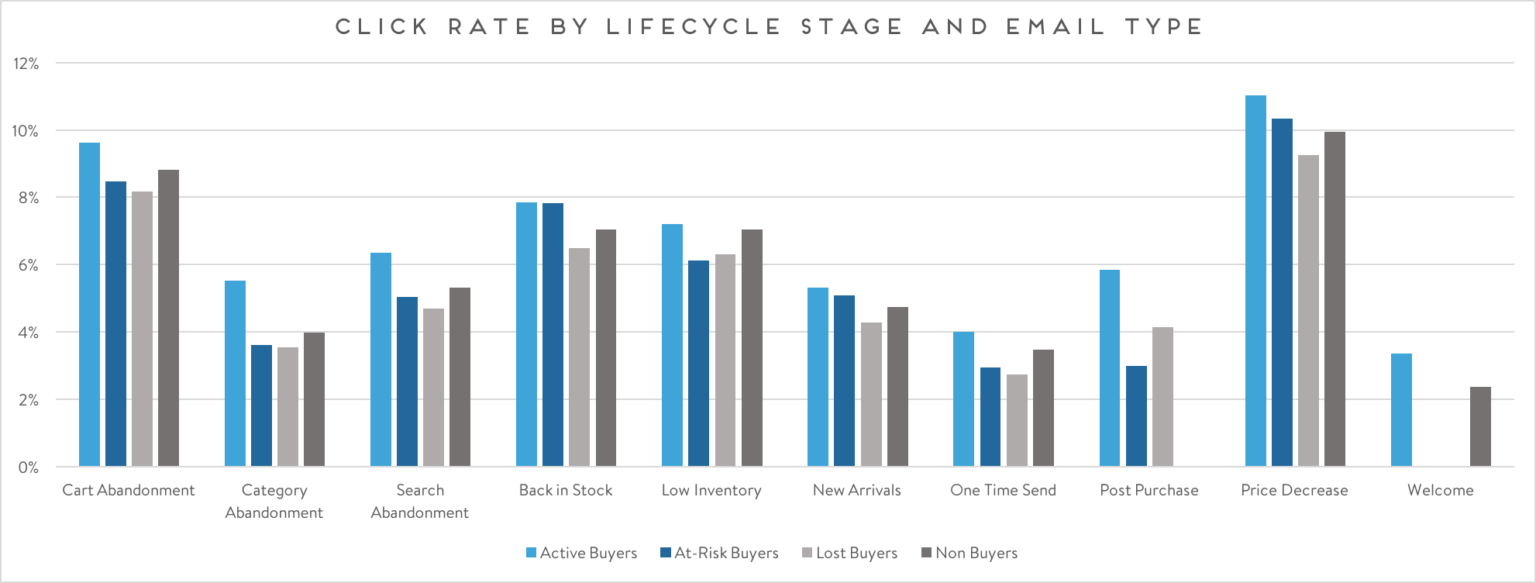

Benchmarking Email Engagement by Lifecycle Stage and Email Type

When breaking down the benchmarks by type of email rather than retail vertical, we see similar trends.

To start, active and non buyers still deliver the highest open and click rates across the board. However, there are a few notable nuances to this trend when we benchmark by type of email. Specifically, at-risk buyers tend to engage at much higher rates with back-in-stock alerts, new arrivals emails and price decrease notifications. Based on this data, these three emails represent some of the best levers to pull when trying to save at-risk customers.

Engagement patterns also hold steady when it comes to conversions and revenue per email, with active buyers leading the way, followed by at-risk, lost and non buyers, respectively. Non buyers actually deliver the highest revenue per email for welcome emails, however this is to be expected (note: active buyers who receive welcome emails are those who opt-in to receive emails at the time of their first purchase).

What’s most surprising in this set of data is that non buyers convert at comparatively high levels on search abandonment emails and deliver a high revenue per email on low inventory and cart abandonment emails. These findings reveal some of the most lucrative emails to get in front of non buyers to drive more first purchases (and higher value first purchases).

How Will You Improve Targeting for Unique Groups of Buyers?

How will you put these findings into action to target unique groups of buyers with the most relevant emails and offers? Get inspiration from leading retailers in our Personalized Marketing Lookbook, which showcases how to think about audiences differently to create more relevant customer experiences.