How Non, One-Time & Multi-Time Buyers Engage Differently

A look at email engagement benchmarks for targeted audiences

One size does not fit all.

As an ecommerce marketer who wants to drive revenue and establish customer loyalty, you know all too well the importance of creating highly relevant experiences for your shoppers.

Most often, the best way to do so is to develop unique audiences of customers so that you can communicate with each of those groups differently. For example, you might engage customers differently or share different offers based on factors like product or discount affinity, lifecycle stage, lifetime value, loyalty program membership, purchase history and the list goes on.

Split Your Audience, Split Your Benchmarks: Benchmarking Email Engagement for Targeted Marketing

Not only does splitting your audience based on factors like affinity or lifecycle stage allow you to get much more targeted in your marketing, but it also enables you to make more strategic decisions about where, when and with what offers and messages to best engage specific customers.

But how do you know if your efforts are successful? One of the reasons to split your audiences into more targeted groups is because you can expect each group to engage slightly differently, and that means you can no longer benchmark performance against one-size-fits-all metrics.

To answer the question of what engagement should look like for various audiences, we decided to dig into email performance data based on a variety of different ways to split your audience. First up: A look at how engagement differs among non buyers, one-time buyers and multi-time buyers.

Inside the Benchmarks: Comparing Email Engagement for Non Buyers, One-Time Buyers and Multi-Time Buyers

Our analysis on retail’s one-and-done buyer problem revealed that the more times shoppers purchase from any given retailer, the more likely they are to purchase again and the greater their potential customer lifetime value becomes.

Now let’s take a look at how the number of times shoppers have (or haven’t) made a purchase affects email engagement.

Benchmarking Email Engagement for Non Buyers vs. One-Time Buyers vs. Multi-Time Buyers by Retail Vertical

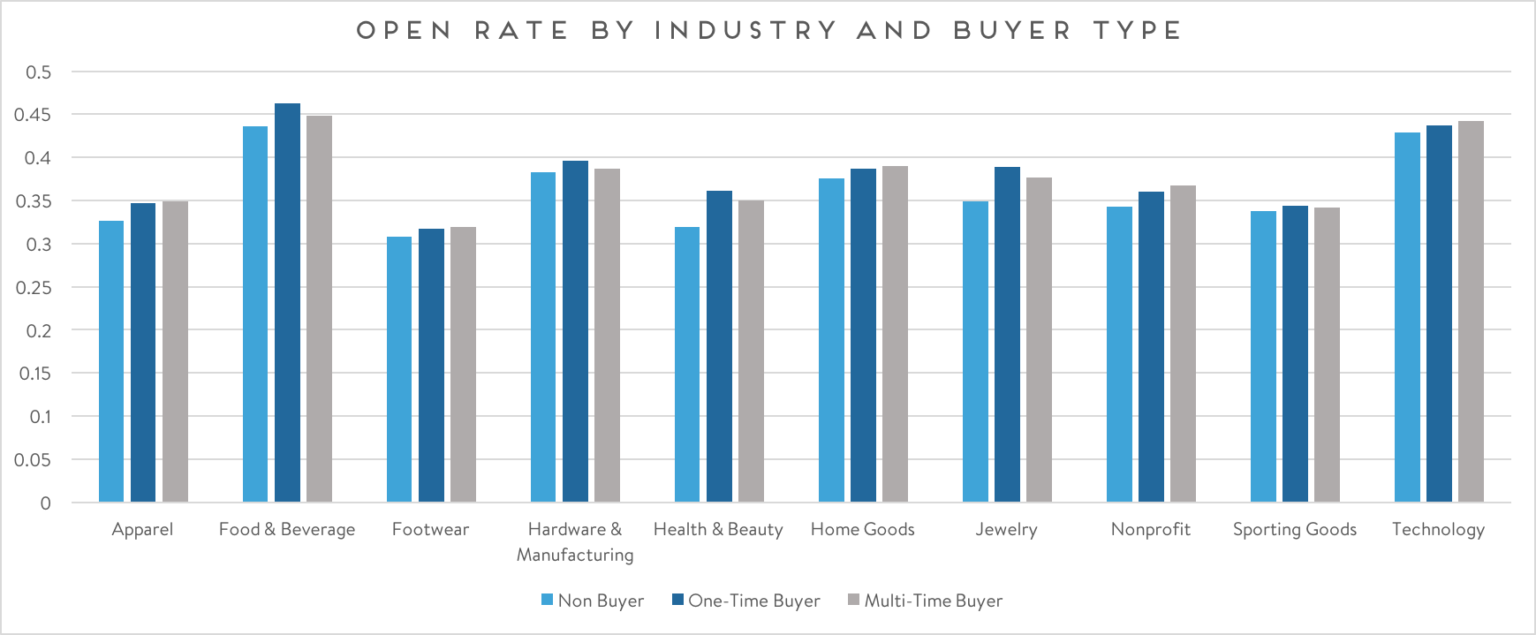

At the retail vertical level, we don’t see too much variation in open rates among non, one-time and multi-time buyers.

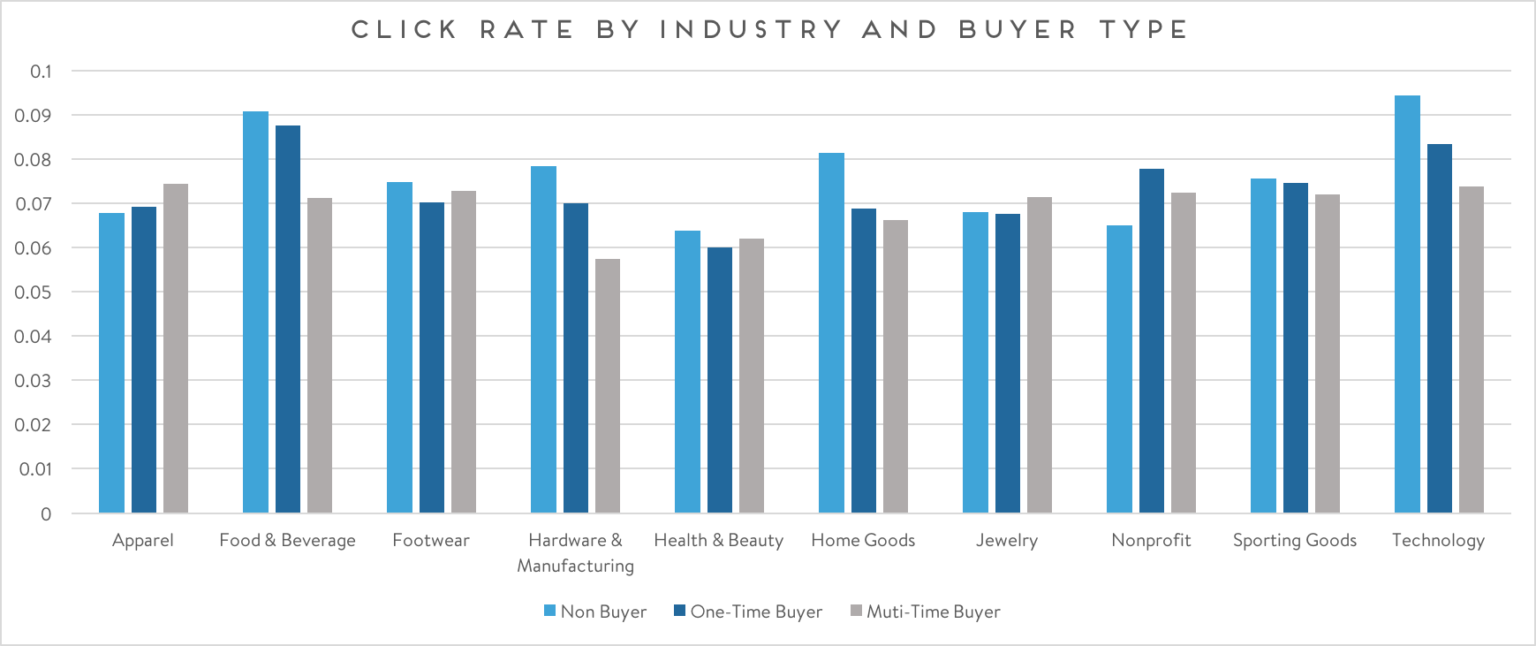

Click rates, on the other hand, do reveal some notable differences in behavior, with non buyers actually showing the highest engagement for most types of retailers, with the exceptions of jewelry, apparel and nonprofit organizations.

We likely see lower click rates among previous buyers because many in this group have a well-defined purchase cadence, for example those who make a purchase every 30 or 50 days, from which they don’t typically deviate. As a result, shoppers in this group are less likely to engage until they are ready to buy again.

Non buyers, on the other hand, are still browsing and considering their first purchase, making them more likely to engage with emails. This propensity to engage reveals a significant opportunity to convert an already interested audience of new customers.

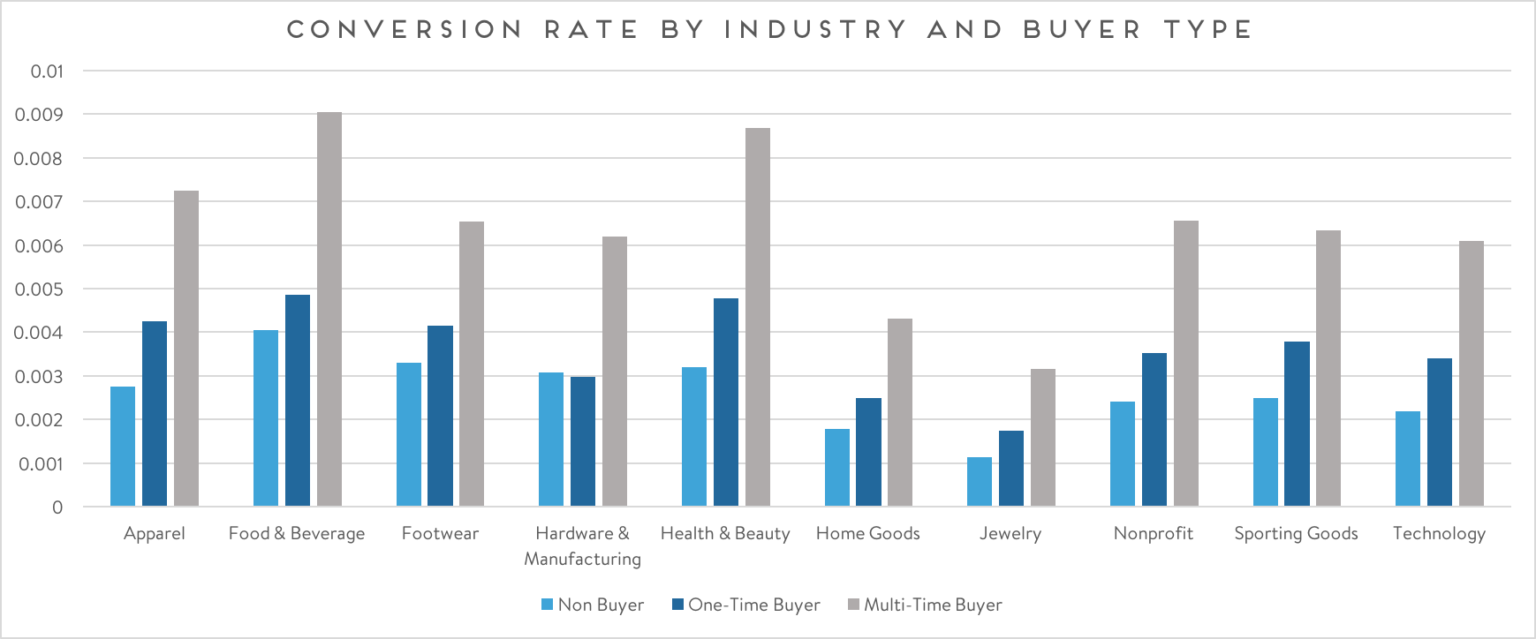

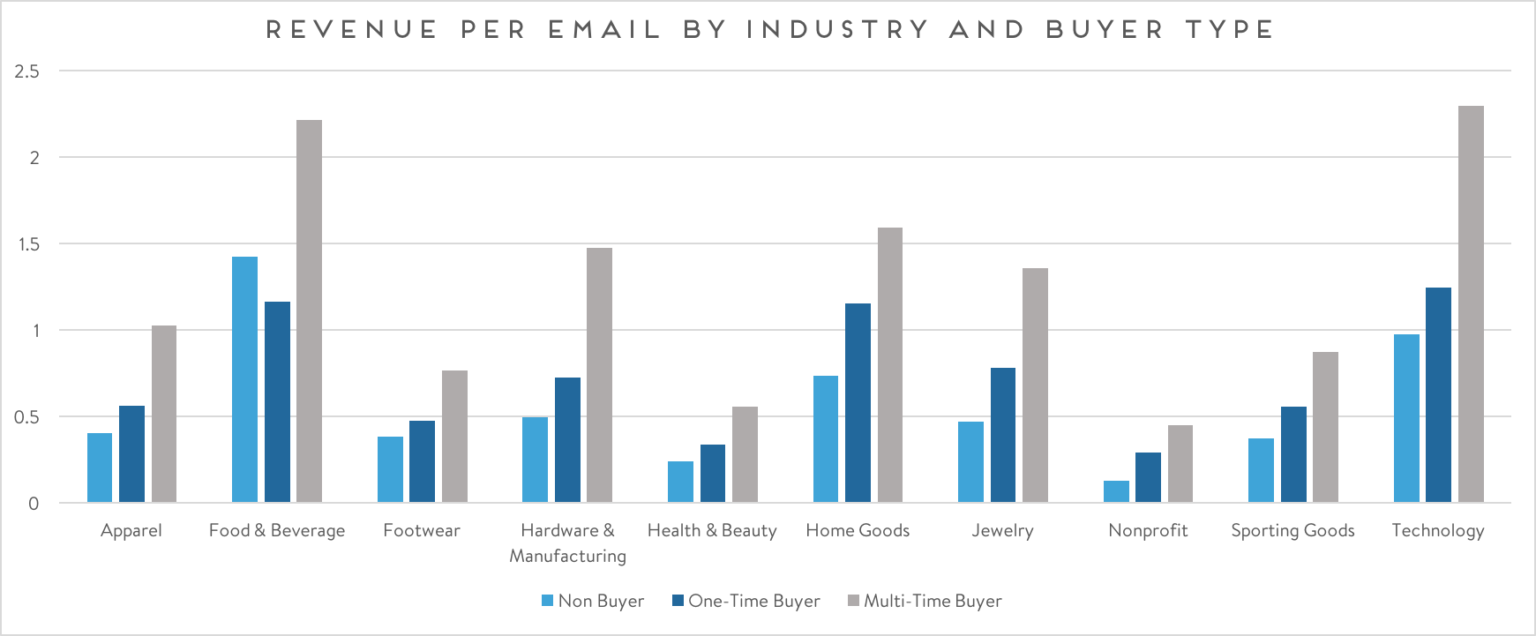

But even though non buyers are most inclined to click through the emails they receive, multi-time buyers deliver the highest conversion rates and, thus, revenue per email. This makes a click from a multi-time buyer far more valuable than a click from a non or one-time buyer. As a result, targeting multi-time buyers with ultra-relevant offers to increase their engagement and hopefully decrease the time between their purchases can deliver high returns.

Interestingly, food and beverage retailers see a higher revenue per email from non buyers who make their first purchase than they do from one-time buyers who make their second purchase.

Benchmarking Email Engagement for Non Buyers vs. One-Time Buyers vs. Multi-Time Buyers by Email Type

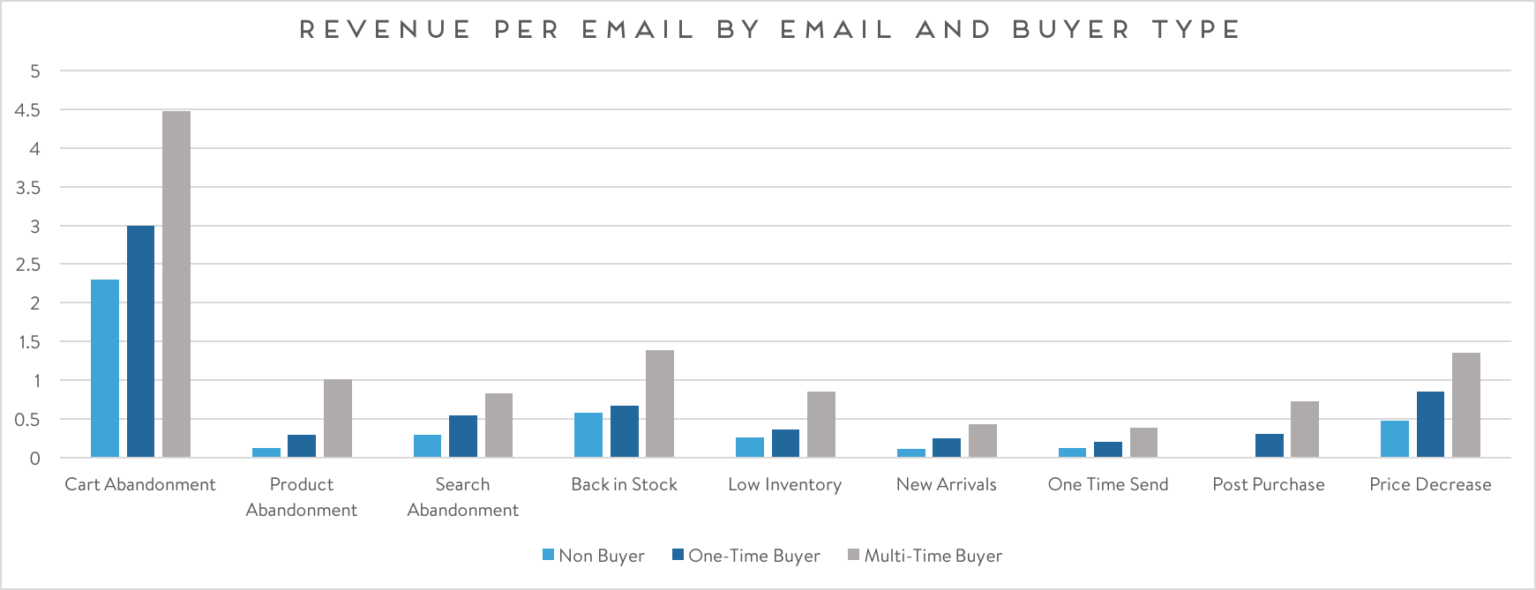

When breaking these benchmarks down by type of email rather than retail vertical, several noteworthy insights emerge.

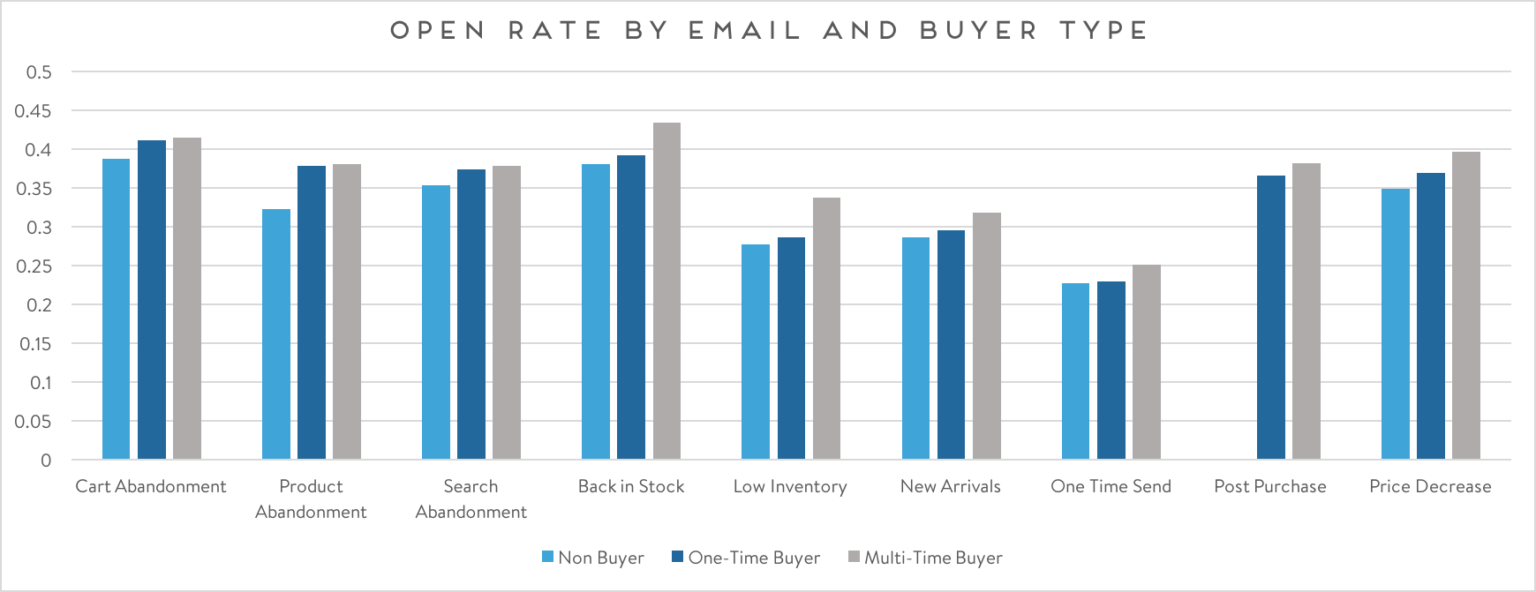

Open rates generally remain fairly steady, though we see a much higher propensity for multi-time buyers to open certain types of emails, including one-time batch sends, back in stock alerts, price decrease notifications and low inventory alerts.

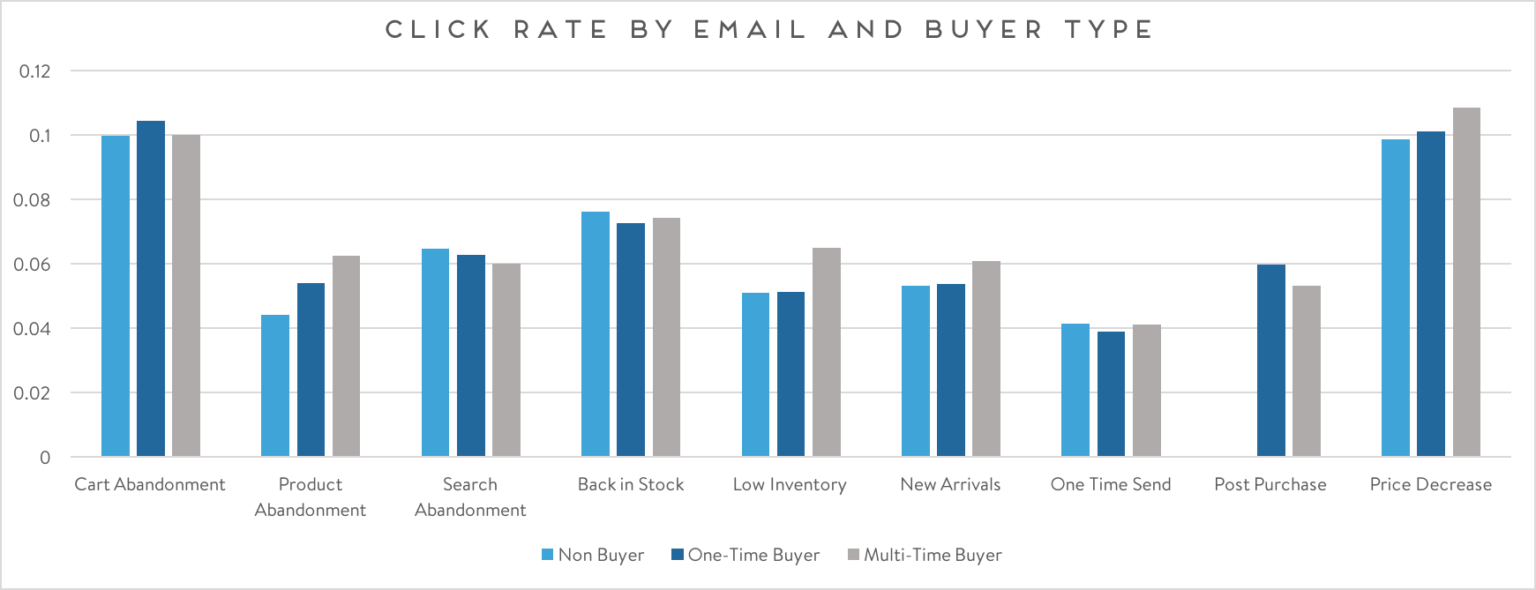

Looking at click rate, we see multi-time buyers are most likely to click on product abandonment emails, low inventory alerts, new arrivals messages and price decrease notifications, while one-time buyers are most likely to click on cart abandonment and post purchase emails. All three groups click at similar rates on search abandonment, back in stock and batch emails, with non buyers showing a slight edge in level of engagement. In general, we see that one-time and non buyers engage relatively similarly when it comes to clicking on various types of emails.

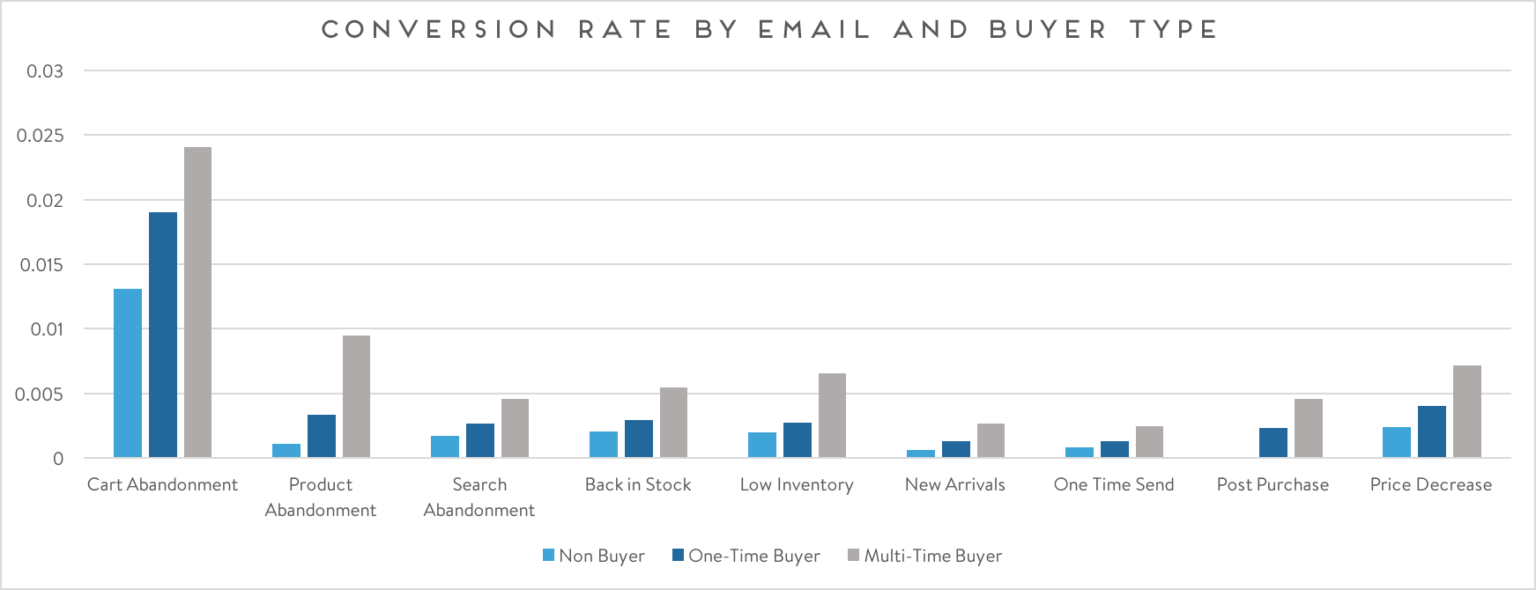

Once again, multi-time buyers deliver the highest conversion rates and revenue per email across the board.

How Will You Target Unique Groups of Buyers Differently?

How can you put these findings into action to develop unique groups of buyers and target them differently? Get inspiration from leading retailers in our Personalized Marketing Lookbook, which showcases how to think about audiences differently to create more relevant customer experiences.