How High Spenders & Low Spenders Engage Differently

Does shoppers’ average order value impact email engagement?

For retailers, personalization is the name of the game. Every ecommerce marketer is well versed in the need to create relevant experiences for customers by building targeted audiences segments and surfacing personalized product recommendations.

But what happens next? Once you create that personalized experience, how do you measure success and use that data to continue to improve your marketing efforts?

If you’re going to split your audience into different groups to deliver more targeted marketing, you also need to think about email performance differently. In support of this mission, we previously looked at how purchase history impacts email engagement. Today, let’s look at how email engagement differs based on buyer spend.

Audience-Based Benchmarks: Comparing Email Engagement for High Spenders and Low Spenders

High spenders are valuable customers. Of course spending more per order leads to more revenue for your brand, but data also reveals that the more customers spend on their first purchase, the more likely they are to make a second purchase.

But how does customer spend impact email engagement? Is there a reason to market to these customers differently? Let’s take a look at the benchmarks.

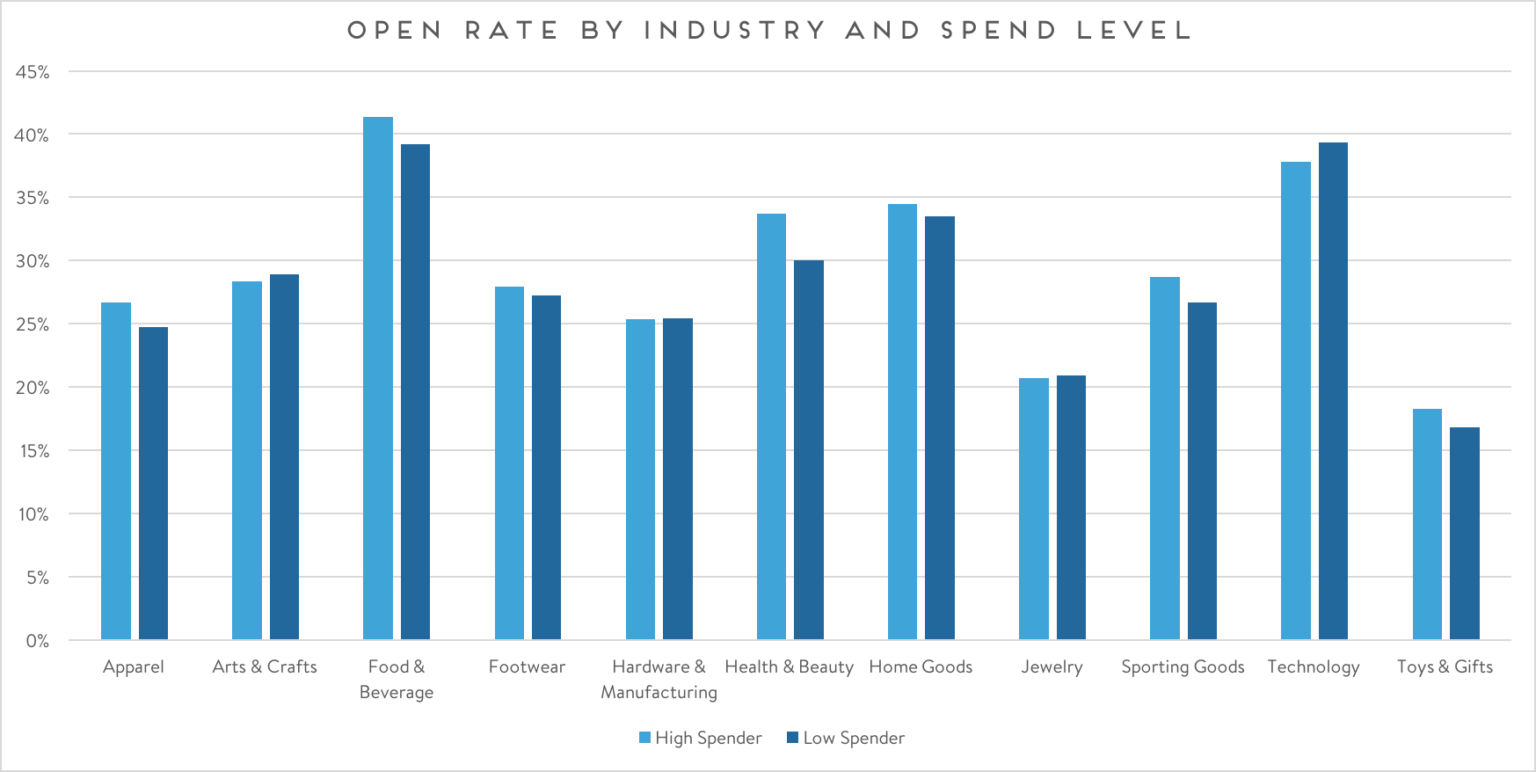

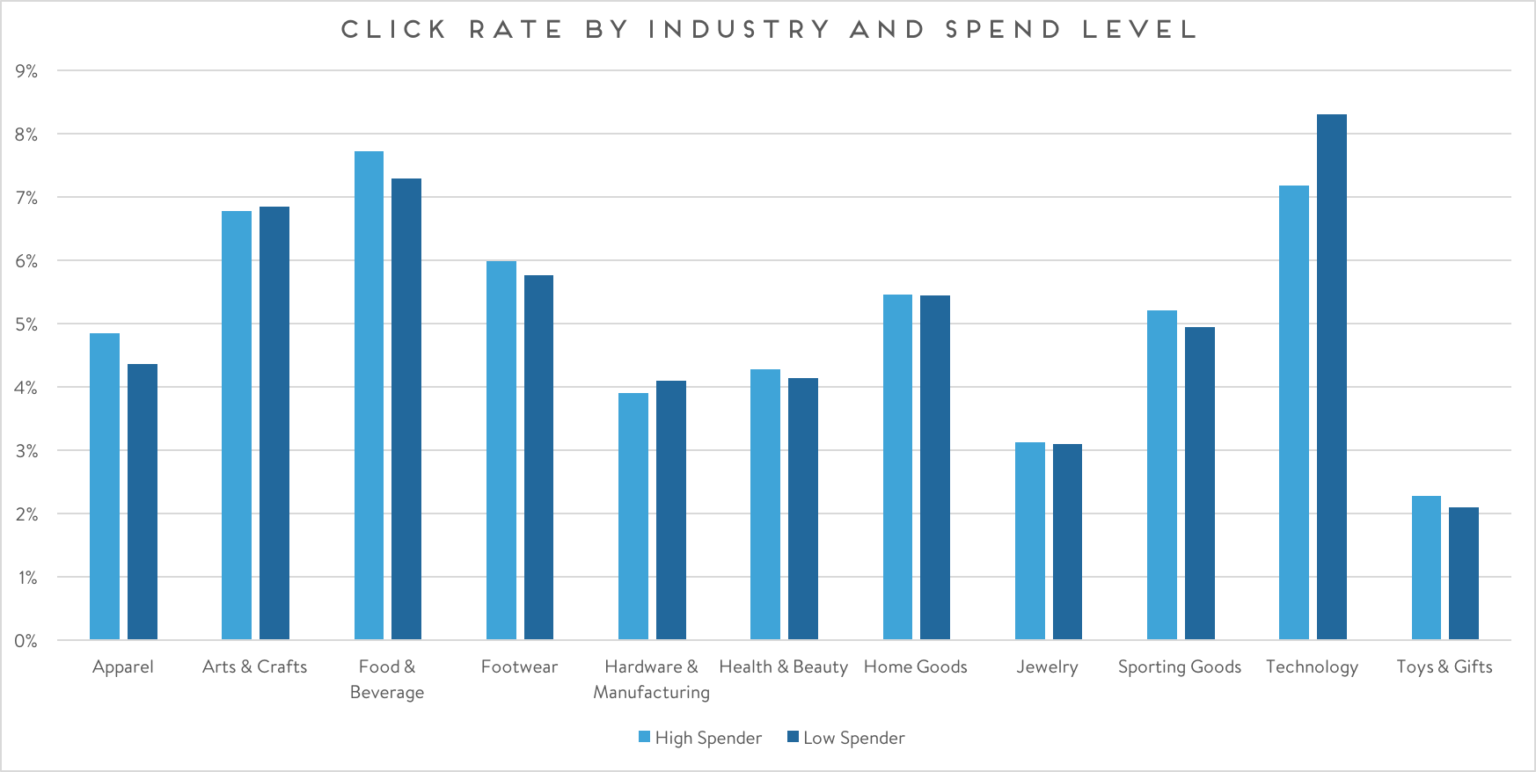

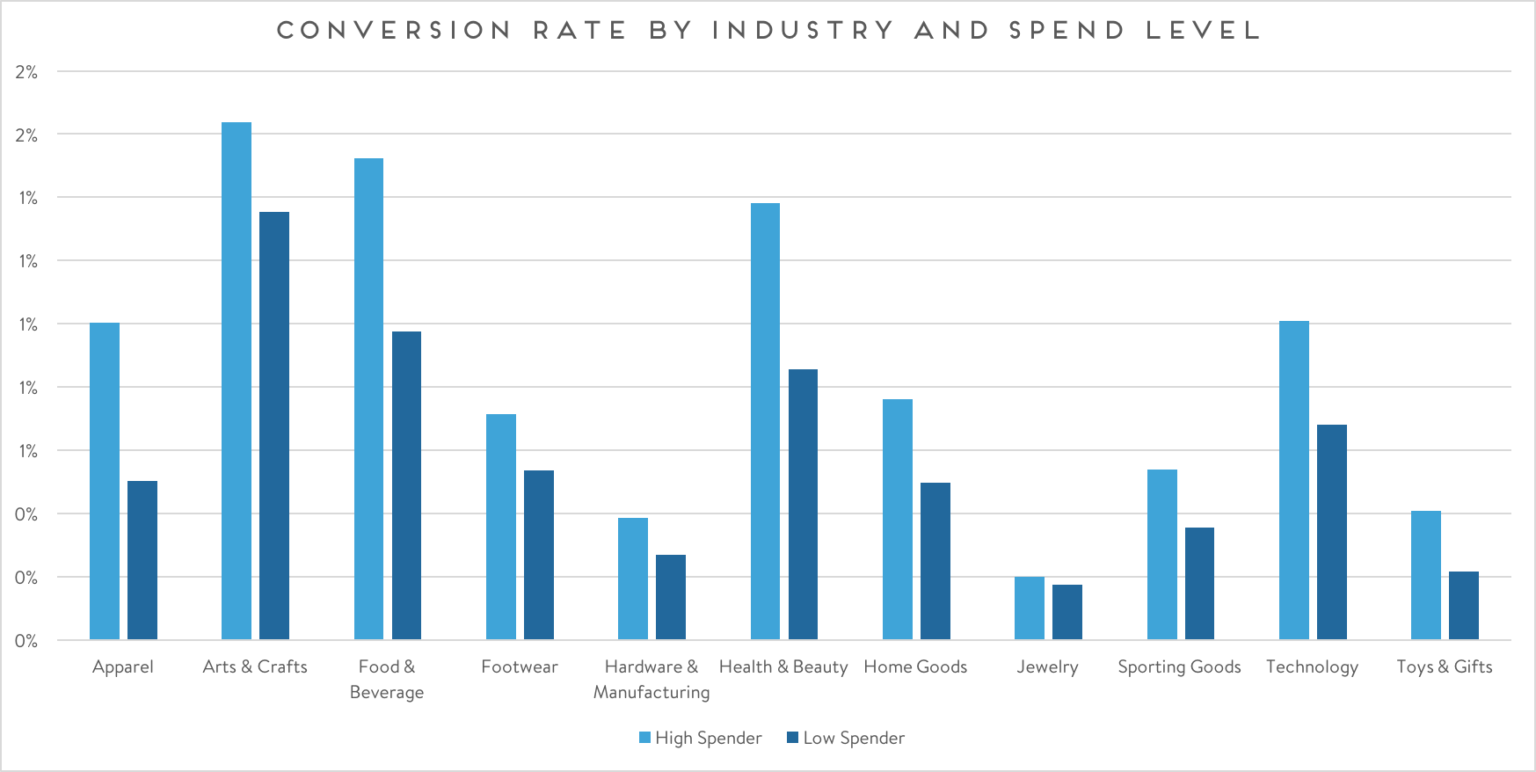

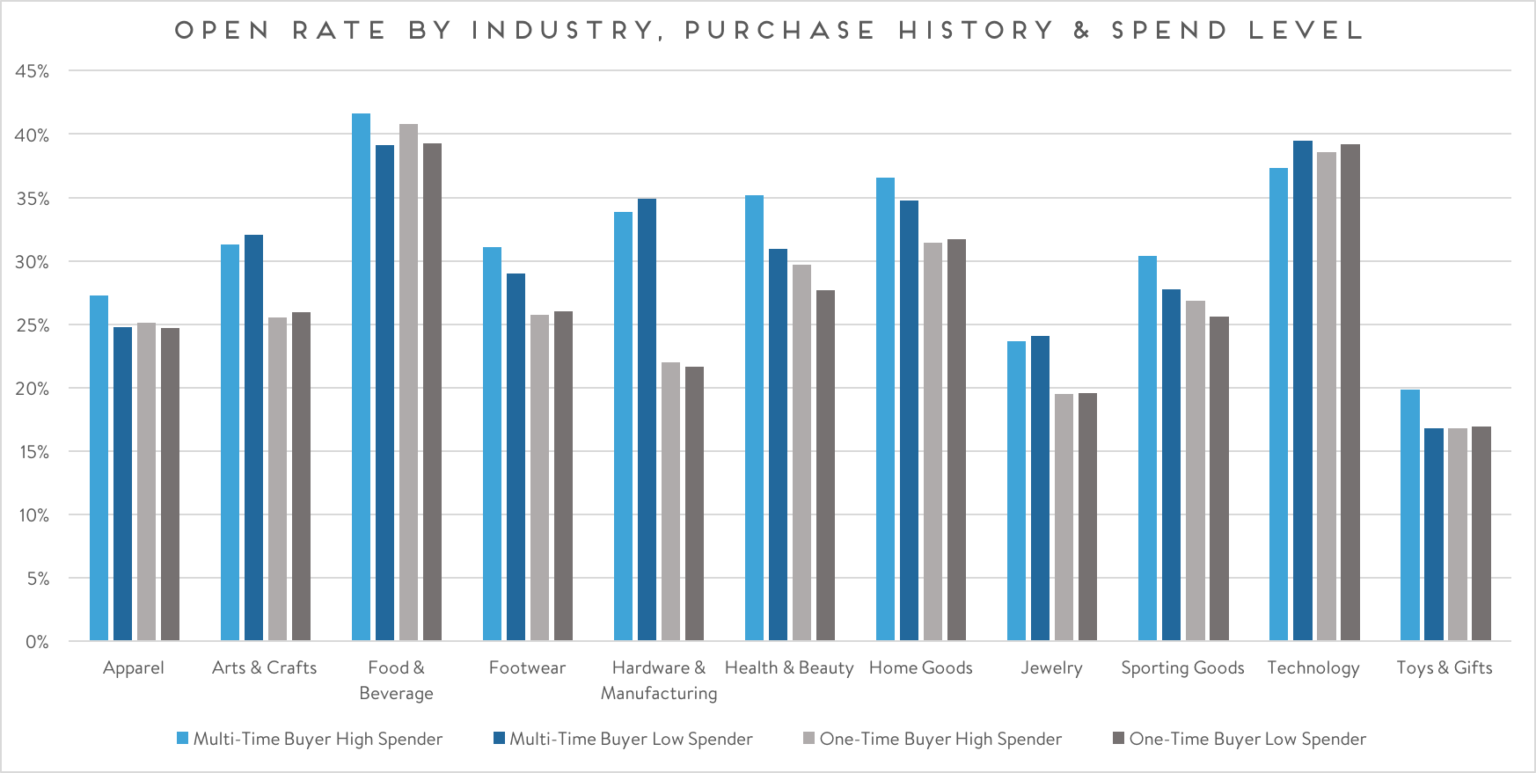

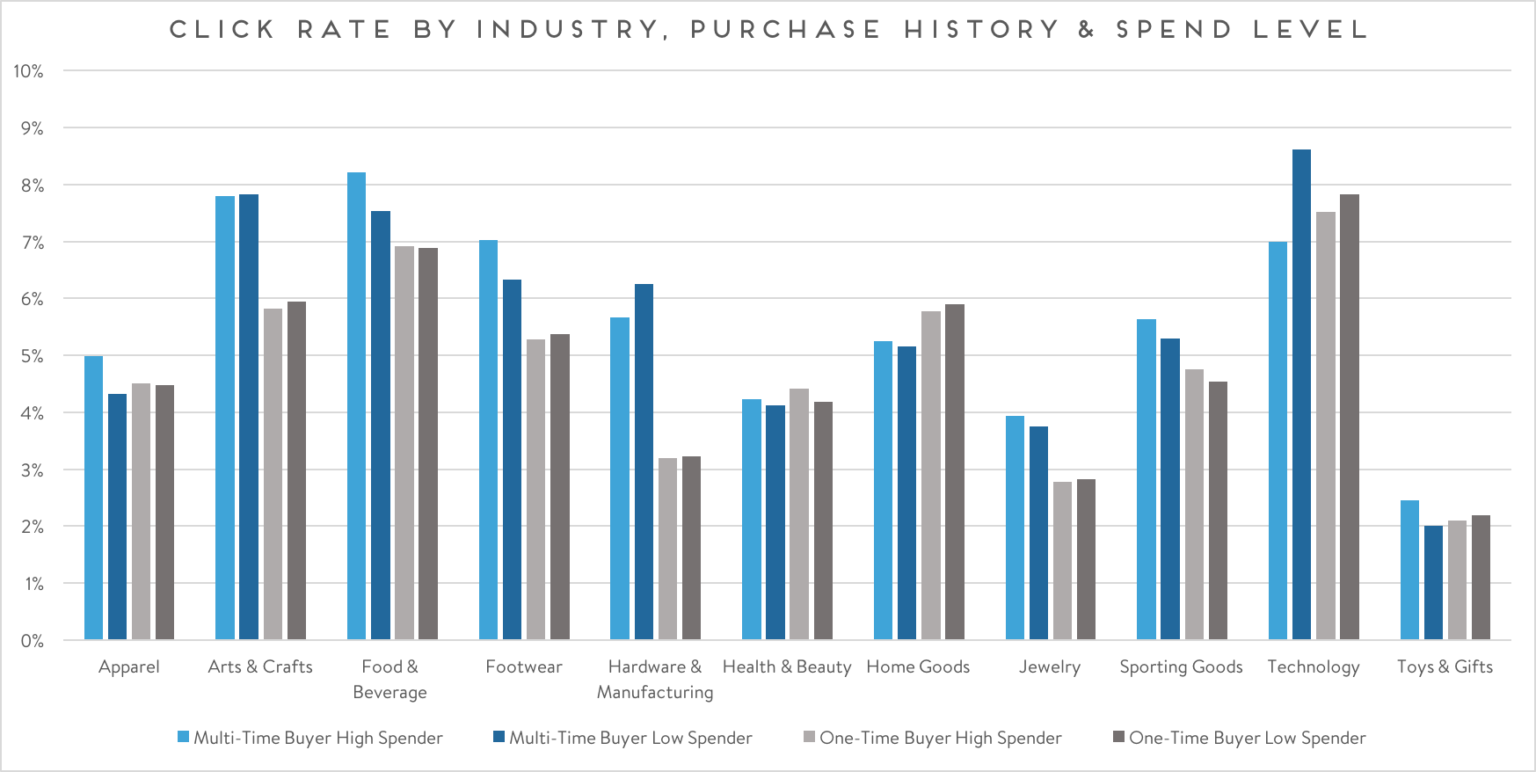

Benchmarking Email Engagement for High Spenders vs. Low Spenders by Retail Vertical

At the retail vertical level, high spenders and low spenders engage at fairly similar rates when it comes to opening and clicking in emails.

However, that’s where the similarities end, as we see a big discrepancy in conversion rate between the two groups, with high spenders converting an average of 50% more than low spenders.

We can likely attribute this difference in conversion to the level of loyalty associated with spend. Specifically, the more shoppers spend with your brand, the stronger the connection they are likely to feel and the more likely they are to buy from you again. This finding reveals a continued correlation between order value and likelihood to buy again that extends beyond the first purchase.

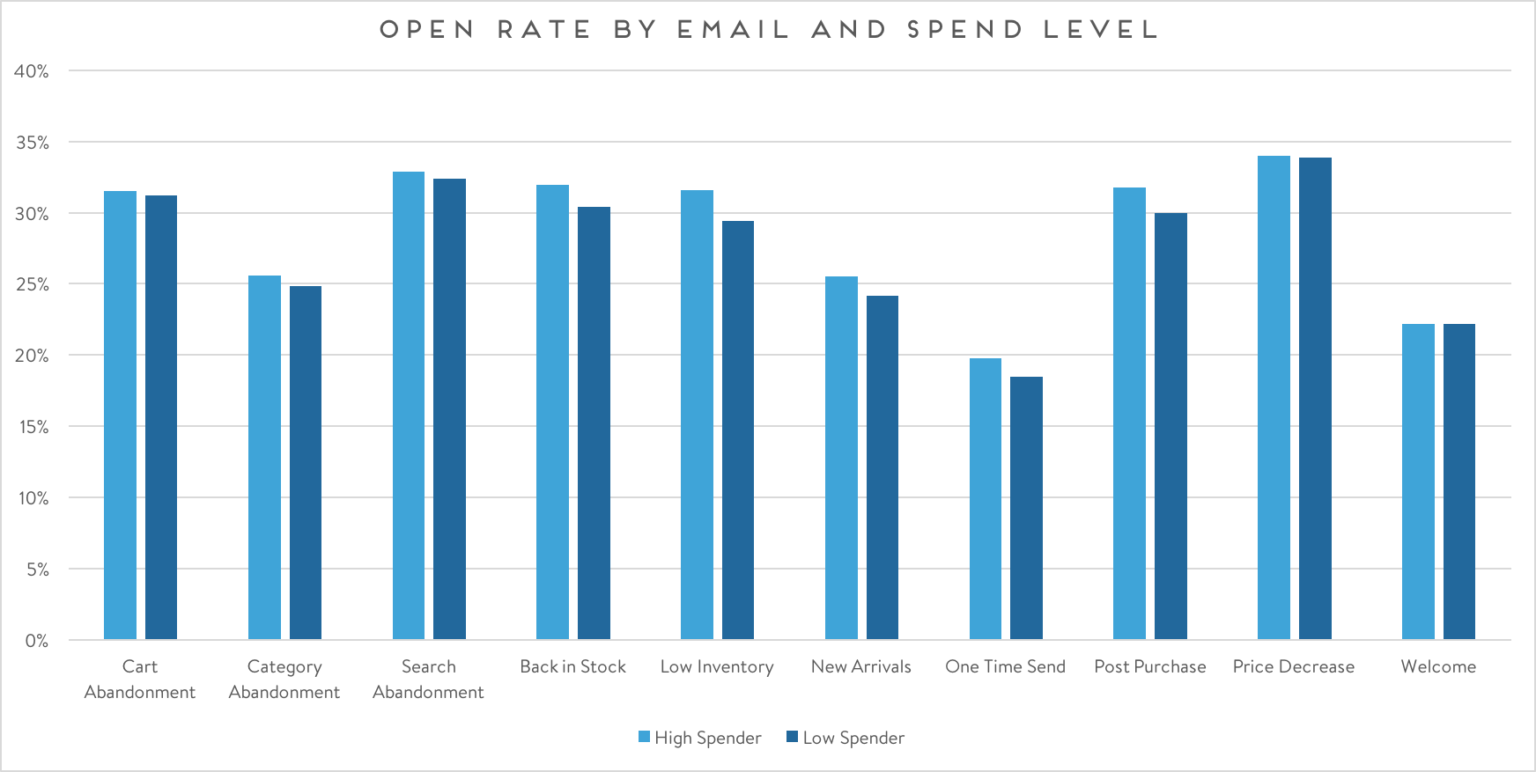

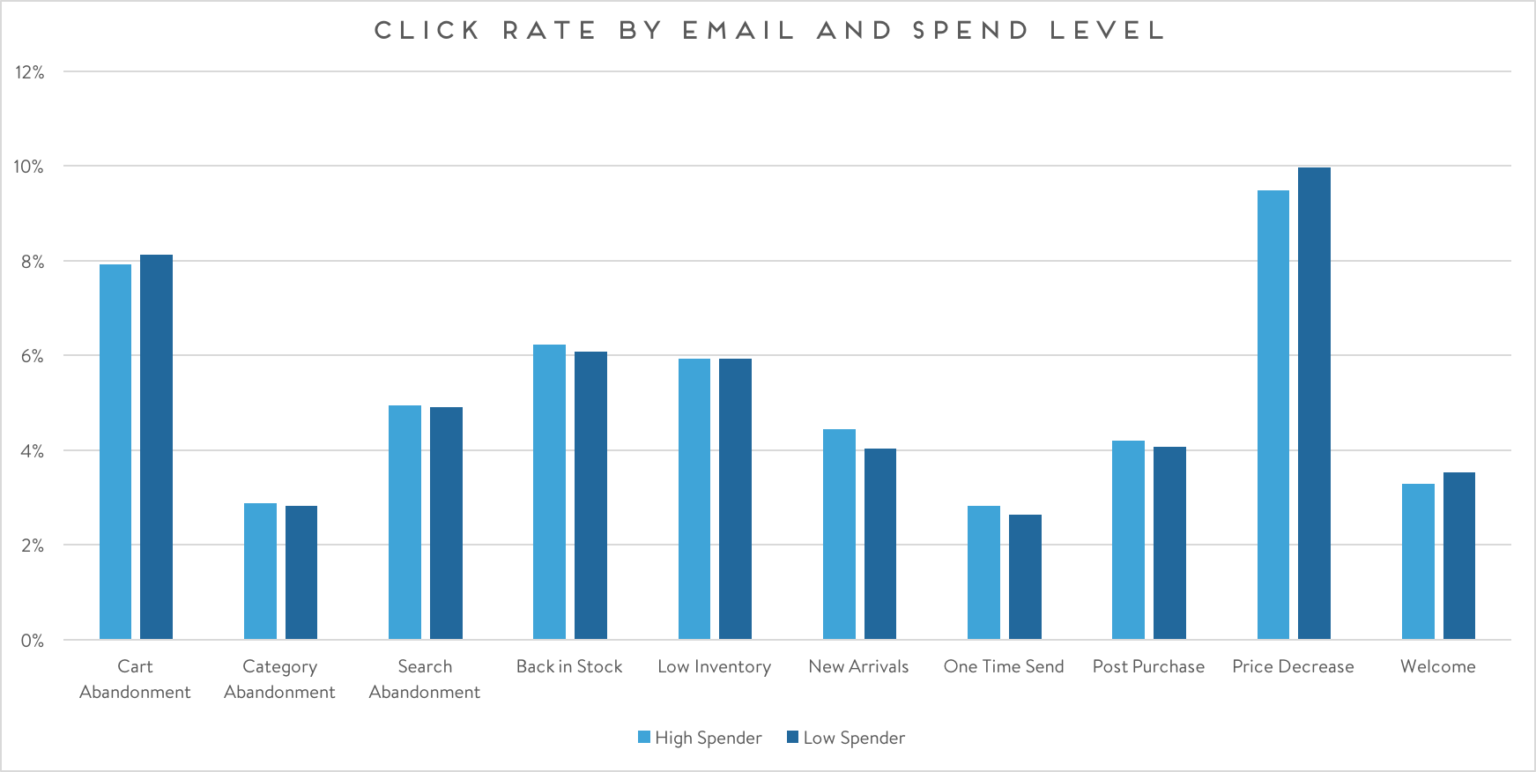

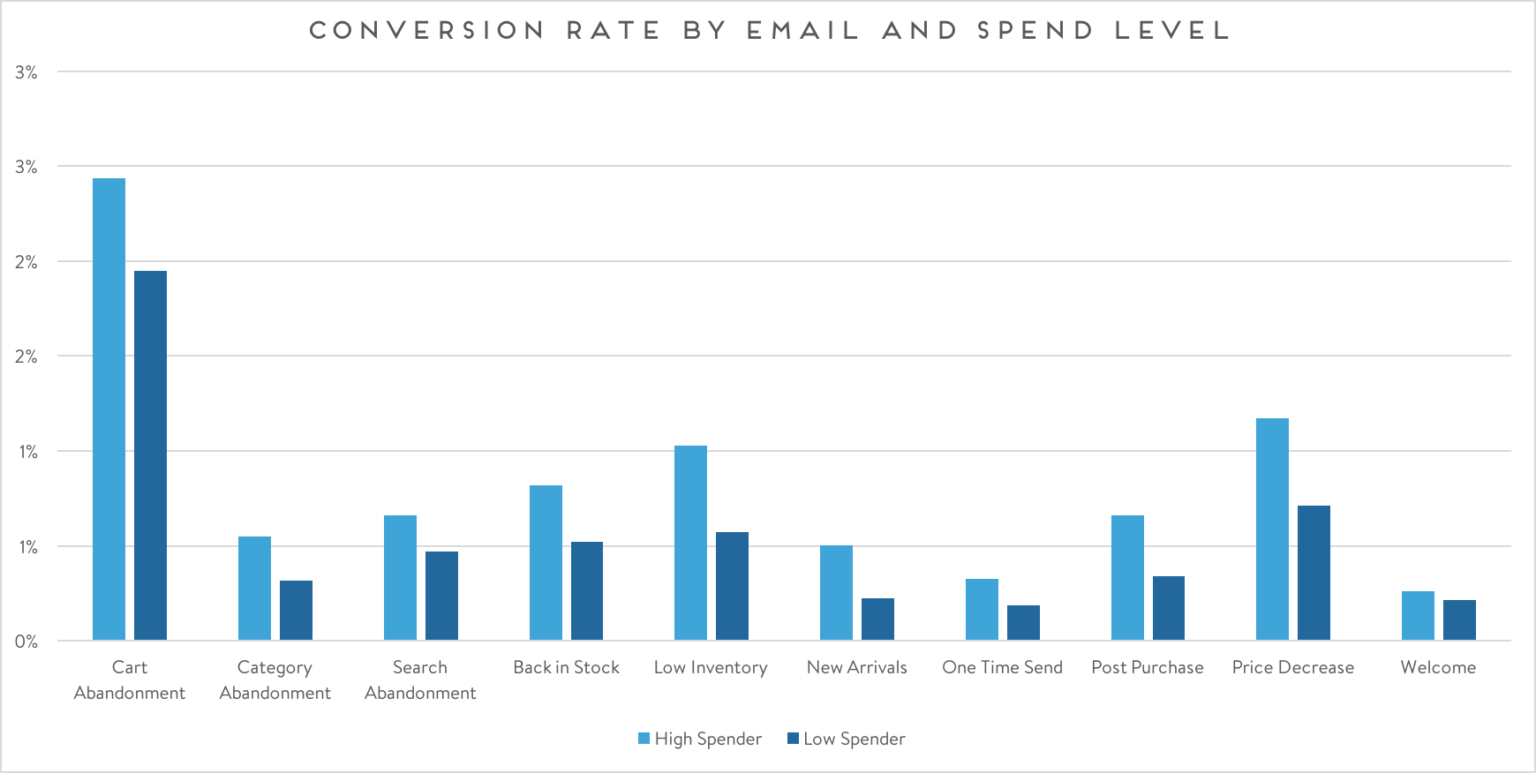

Benchmarking Email Engagement for High Spenders vs. Low Spenders by Email Type

When breaking down these benchmarks by type of email rather than retail vertical, we see similar trends.

While open and click rates remain fairly steady between high spenders and low spenders, high spenders convert at higher rates. However the difference in conversion rates when looking at email type is far less pronounced. That said, we can still likely attribute this difference to the higher level of loyalty associated with spending more per order.

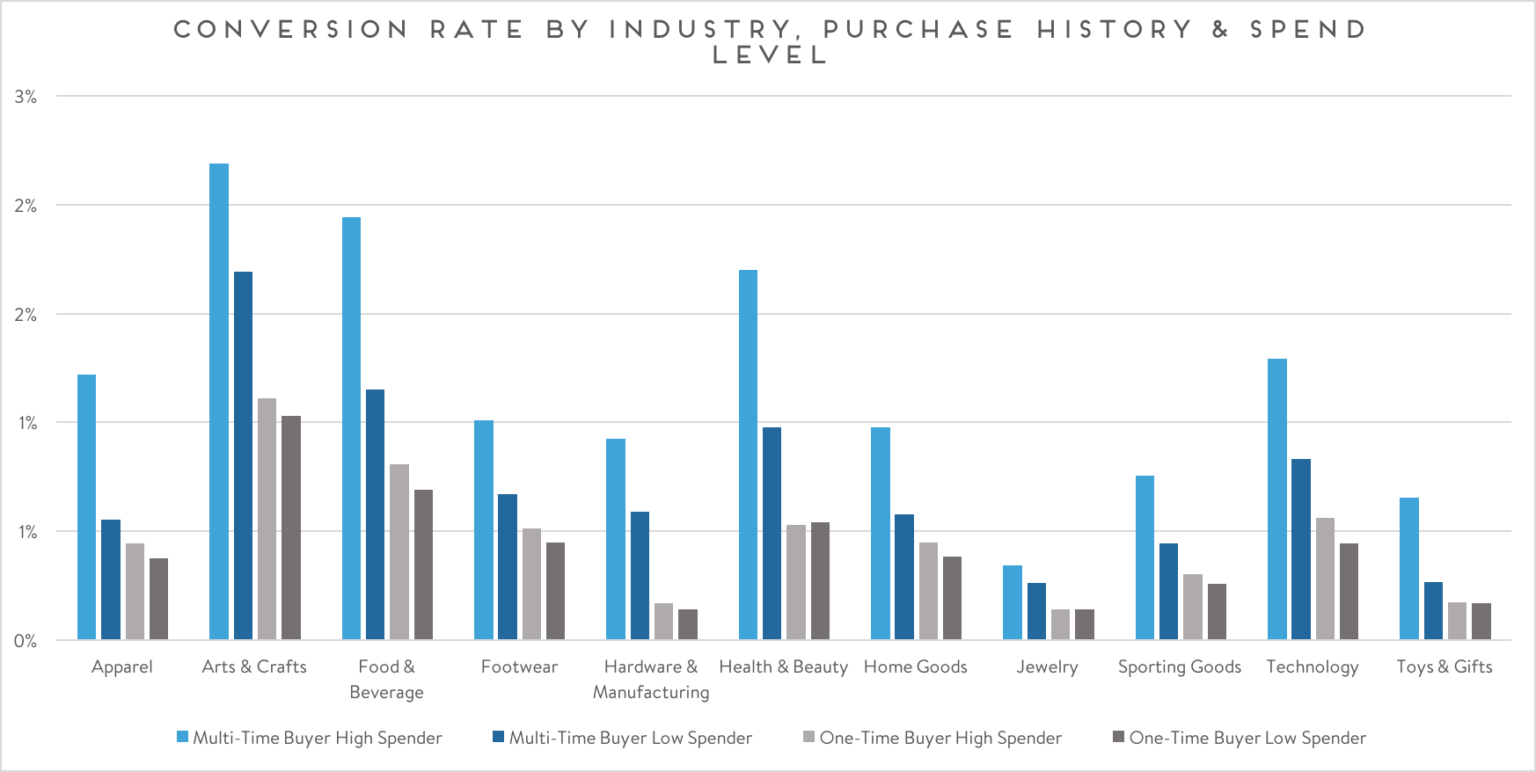

Benchmarking Email Engagement for High Spenders vs. Low Spenders by Purchase History and Retail Vertical

Finally, let’s look at how these benchmarks play out when separating high spenders and low spenders based on whether they’re one-time buyers or multi-time buyers.

To start, open and click rates vary across the board.

For example, customers of all kinds behave similarly for food & beverage and technology retailers, while there’s a clear split between multi-time buyers and one-time buyers for footwear, hardware & manufacturing, home goods and jewelry retailers.

Notably, low spenders who have purchased multiple times from apparel and toys & gifts retailers behave more like one-time buyers.

The most interesting piece of the puzzle comes when we look at conversion rates, as low spenders who have purchased multiple times behave more like one-time buyers than they do like high spenders who have purchased multiple times.

This finding indicates that low spend levels can negate many of the benefits that come from getting shoppers to make more purchases. As a result, enormous revenue and loyalty opportunities exist if you can take steps to increase customers’ order values, for example through onsite product recommendations, pop up offers, checkout modals and triggered emails.

How Will You Get Targeted with Unique Groups of Buyers?

What does it take to put these findings into action to target unique groups of buyers with more relevant offers? Get inspiration from leading retailers in our Personalized Marketing Lookbook, which showcases how to think about audiences differently to create more relevant customer experiences.