The holiday shopping season may be months away. But for high-growth retailers, preparation starts now. Execute a strong customer acquisition and reactivation strategy, and you’ll introduce thousands of new shoppers into your ecosystem. Fall short, and you’ll have to wait 12 months to try again.

Retailers know the tremendous opportunity packed into Black Friday and Cyber Monday (BFCM). This four-day window is a chance to attract new shoppers, primed to buy, and convert them into loyal customers.

What the data says

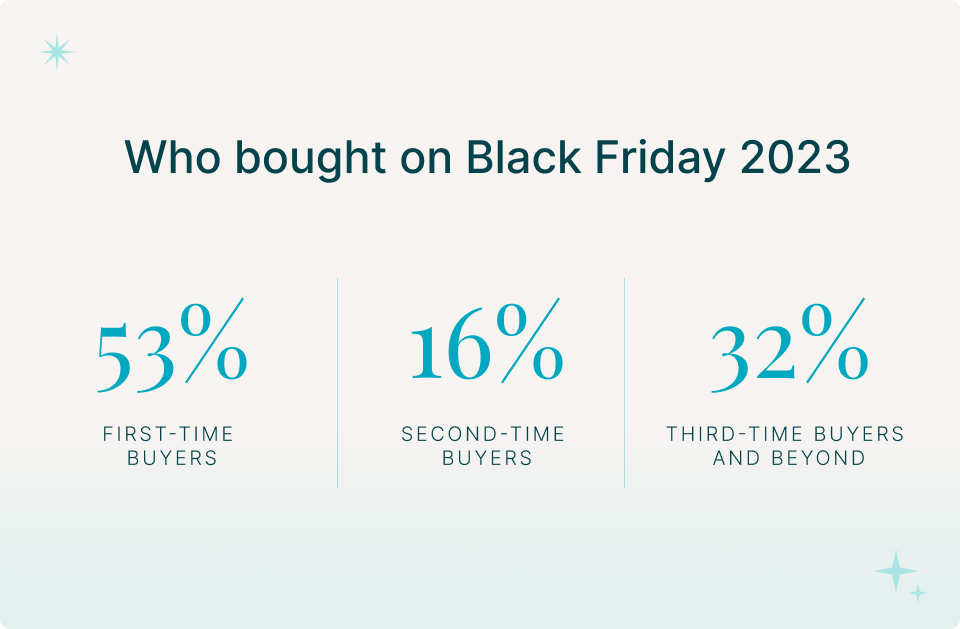

In 2023, 53% of BFCM buyers made their first brand purchase. Not surprising. But what may surprise you is what happened next. Track these first time buyers over the next year, and only 16.5% of them went on to make a second purchase — the rest fell off, possibly never to return.

Here’s the good news: Retailers who successfully deepened the relationship and drove a second purchase were able to build lasting brand loyalty. The second largest segment of BFCM represents four or more purchases from a single retailer. These loyal customers represent 32% of BFCM shoppers for mid-market retailers, and a staggering 44% for enterprise retailers.

What this means for retailers

BFCM represents a concentrated opportunity for growth. It can also easily turn into wasted effort as bargain hunters and gift buyers turn out in droves.

How can retailers sort through all the noise?

In this guide, we’ll introduce you to a proven framework deployed by more than 100 retail brands, including Foot Locker, Carhartt, GAP, Neiman Marcus, and Lenovo. By leveraging customer identification and on-command personalized communications, retailers are able to focus their efforts on high-ROI shoppers.

Consider this your blueprint for maximizing customer identification, helping you seize every opportunity to move shoppers through the funnel and to turn browsers into loyal customers, ultimately setting the stage for an exceptional BFCM and the quarters to come.

Shopper identification: The foundation of customer movement

The retail landscape is hyper-competitive. Customer acquisition costs continue to rise. And retailers, more than ever, need to capitalize on shoppers who visit.

BFCM brings a surge in traffic to retailers’ owned channels, providing an unparalleled prospecting opportunity. During BFCM last year, site traffic remained relatively static, decreasing just 1.51% from 2022. But most retailers were not able to take advantage of this inflow. Instead, 79% of BFCM shoppers came, browsed, and left. Without identification, their future movements were unknown.

How do you turn one-time shoppers into loyal VIPs?

The starting point is shopper identification. Identification is the process of recognizing each individual shopper by addressable identifiers and connecting them to their unique behaviors, preferences, and attributes.

With strong shopper identification, retailers can drive customer movement, using “signals” to understand shopper behavior and reach them with relevant messaging. These signal-based strategies deliver a personalized experience for every shopper.

The shopper identification difference

Identification has been a hot topic for years, but it continues to be an often misunderstood or overlooked term for retailers. Today, high-growth retailers prioritize identity recognition, going beyond identity resolution — which relies on historical and purchase data — to incorporate real-time, in-session data.

Not all shoppers make a purchase and not all customers act the same way. By focusing on forward-looking signals rather than backward-looking transactions, retailers are better equipped to take control of their revenue growth.

How to maximize shopper identification

High-growth retailers are now tracking identification rate alongside critical business metrics such as conversion rates and customer acquisition costs. This strategic focus, paired with a transparent identification network and diverse capture tactics, turns unknown visitors into known prospects.

For example, lead capture campaigns prompt shoppers to opt in for emails and SMS messages about products and updates. Additionally, integrating with a first-party identification network is a great way to increase shopper identification. These networks compile data across brands, platforms, and devices for a more complete picture of each shopper.

Driving engagement: Pairing automation with conversion opportunity

Today, shopping behavior is more fluid than ever. Shoppers browse at all hours of the day, from mobile devices, desktop computers, and in-store. And their shopping preferences are just as diverse. When retailers rely on predefined journeys and complex decision trees, they miss important opportunities to respond to customer signals.

BFCM demonstrates a wide range of shopping behaviors. Some shoppers plan ahead, while others buy on impulse. And trends change over time. Last BFCM, for example. Bluecore data showed an increase in planning behavior, with shoppers viewing an average of 12 unique products 23 times in the weeks leading up to BFCM.

Retailers who are equipped to track customer behavior and respond with signals-based messaging will win the day.

As retailers plan for the full array of BFCM shoppers, it’s critical to set up automated triggers — that leverage the rich signals captured through the identification process — into every step of the buying experience.

These triggers set you up to capture conversion opportunities. And they fall into three main categories, each of which has a different role to play in guiding a shopper down the path to purchase.

Behavior-based triggers

The standout trigger here is abandonment — and not just cart abandonment. Say a shopper searches for a black sweater, then browses some other products and becomes idle. This signal can be used to trigger an email, but it can also trigger a pop-up modal onsite to shorten the path to conversion. Use these signals to determine which products to recommend.

- Interaction History displays products that are associated with the given audience. This dynamically changes the recommended products to one of the following: products viewed, added to cart, purchased, searched, interacted with.

- Best Sellers displays best selling products (based on the number of purchases) from the last 24 hours, 7 days, or 30 days. This is based on the category of input product(s), sitewide best sellers, or on other product attribute(s).

- New Arrivals displays new products from the last 24 hours, 7 days, or 30 days. This is based on the category of input product(s), sitewide best sellers, or based on other product attribute(s).

Merchandise-based triggers

Sometimes it’s not just what the customer does — it’s what the merchandise does. If an item is running low, let your shopper know. If the price just dropped, send a note to get them excited. If their target product is out of stock, suggest similar in-stock items. How your audience interacts with your catalog presents a deeper view of shopper behavior. More unique opportunities can be found by communicating with customers based on trends in your product catalog.

- Rockstars are products with the highest conversion rates and the most views. They’re flashy. You know they captivate shoppers all the way through to a completed purchase. Get them in front of shoppers you know enjoy the category.

- Cash cows are products that have generated the most revenue. Your cash cows mean big money and they can be relied on. Surface these products in email campaigns to shoppers that have a high likelihood to convert.

- Hidden gems are products with a moderate number of views but high conversion rates. Reveal these to shoppers who have become inactive to help them discover something new.

Lifecycle-based triggers

Predictive modeling analyzes changes in shopper behavior to categorize customers and power automated messages based on the lifecycle stage. These messages nurture customer relationships and grow lifetime value.

They distinguish between customers based on lifecycle stage (active, inactive, lost) and the progression of an individual through the purchase cycle (non-buyer, one-time buyer, repeat buyer). This often includes affinity-based messages that highlight the incentive or product that is most likely to help a shopper convert, as well as replenishment messages.

Customer movement: Moving customers toward long-term loyalty

An uncomfortable fact of retail life: New customers are not immediately profitable. Profitability comes after a customer is acquired and purchases a second, third, and fourth time. But not all customers will meet this phase of long-term loyalty. In fact, Bluecore research shows 30% of customers make 54% of a retailer’s purchases.

As BFCM purchases roll in, retailers must have a way to convert initial interest into sustained buying behavior. The most strategic and cost-effective way to do this is with customer movement, a philosophy that shifts the marketing focus from channels to customers.

The old way of converting subscribers to buyers relied on channel-led tactics.

The new way is customer movement, using channel-agnostic customer signals and automated triggers to turn unknown shoppers into first-time buyers, repeat buyers, and eventually brand loyalists.

Let’s take a look at how customer movement gives retailers control at every stage of the customer lifecycle.

New subscribers to first-time buyers

BFCM puts your brand on center stage, opening the opportunity to connect with new shoppers. Many retailers know the discovery potential of BFCM and include email subscription and SMS opt-in as part of their messaging.

Once identified and in your brand’s ecosystem, it’s time to leverage signals. Customer-focused analytics show behavioral, engagement, and purchase trends over time. From there, retailers can invest in messaging to address negative trends and take advantage of positive behaviors.

This is where triggers become valuable. Going beyond the standard abandonment series is where you have the opportunity to capture conversions further down the funnel. Price drops, low stock alerts, and new arrival triggers can help you turn subscribers into buyers.

At Lulu and Georgia, triggered campaigns account for less than 5% of delivered email volume – but they’re generating 40% of email revenue. One of Lulu and Georgia’s best-performing triggers for moving new subscribers to become first-time buyers is low stock alerts, which drive high conversion because of the urgency and relevancy of the messaging. The combination of efficient paid media targeting and at-the-ready onsite and email triggers yielded 5% list growth and a 133% increase in first-time buyers in just nine months.

First-time buyers to repeat buyers

Next, to boost profitability it’s essential to turn one-off customers into repeat buyers.

Purchase signals paired with automated triggers equip retailers to move customers to their second or third purchase. For example, after your customer makes a purchase, follow up with a strong post-purchase strategy that goes beyond simply messaging them. Consider serving up complementary products, driving people in store, and engaging across multiple channels.

But don’t stop there. Strive for continuous improvement and optimization in all of your messaging streams to cater to cohorts based on where they are in the lifecycle. Take BFCM’s new customers from last year who haven’t purchased since. Retailers should be identifying and tracking cohorts year-over-year to plan relevant reactivation strategies and create experiences that meet customers where they are.

It’s also important at this stage to be proactive, helping customers discover something new. This is where shopper identification data and customer preferences become even more valuable — when data is fed into predictive models, you have the ability to predict things like a customer’s next best purchase and if they need a discount to convert.

Enterprise health and beauty brands, especially, are doing a great job of this — during the last BFCM, 60% of their buyers had purchased from them four or more times. On average across all verticals, 32% of buyers had this level of stickiness.

To increase cross-category discovery and repeat buying, an international health and beauty brand leveraged push-button Next Best Purchase and Discount Affinity models to be more proactive in campaigns. This allowed them to move from one to 10 campaign tests per month.

Inactive to reactivated buyer

The data on repeat business is eye-opening.

Second-time buyers are 101% more valuable than first-time buyers and the likelihood that they will buy again increases with every subsequent purchase. However, these repeat purchases won’t necessarily happen at a predictable cadence. Many customers will lapse and need to be reactivated, which makes engagement a continuous process.

Brand loyalty requires a relationship built on specificity. To reactivate high-value customers, retailers must excel at tailoring personalized experiences that span the entire customer journey. Fortunately, lapsed buyers are still buyers. You already know them and have a strong pool of signals for reactivating them.

Category affinity or hidden gem campaigns — where you are surfacing products in a category that a shopper has a preference for or increasing the visibility of products that are high-converting but less visible — are often effective here.

Another valuable tactic is communicating with shoppers based on their behaviors during the last holiday season. Customers who have purchased from you multiple times during the holiday period in years prior, but have fallen off their typical purchase cadence, may be great candidates for a seasonal winback campaign.

For CITY Furniture, affinity audiences have proven to be effective, not only for keeping their repeat customers buying, but for bringing inactive customers back. During a six-month period before, during and after BFCM, CITY Furniture saw a 118% increase in repeat buyers and pulled 30% of inactive and at-risk buyers back into the fold.

Looking to have a happy holiday season — and beyond?

Talk to a retail strategist