Key Statistics from Black Friday & Cyber Monday 2021

Between the global supply shortage, inflation and uncertainty with the Omicron variant, there were a lot of predictions about how the holiday season would pan out.

Some shoppers were ready to get back out into the Black Friday hustle in their local stores, many were still ready to snag deals from home — and inflation threw an interesting curveball into an otherwise big spending boom leading up to the holiday.

Like every year, the Bluecore team watched it all play out in real time to gain insights into sales and shopper behavior.

We derived data on Black Friday and Cyber Monday from 787 million first-party cookies, 585 million cart events, 4 million unique products, 39.2 million orders and $4.7 billion in total sales across 153 retail brands (47 Apparel, 19 Health & Beauty, 21 Footwear, 15 Home Goods, 11 Jewelry, 11 Specialty Gifting, 22 Sporting Goods, and 7 Technology).

Here are 7 key insights from the full report, which you can find here.

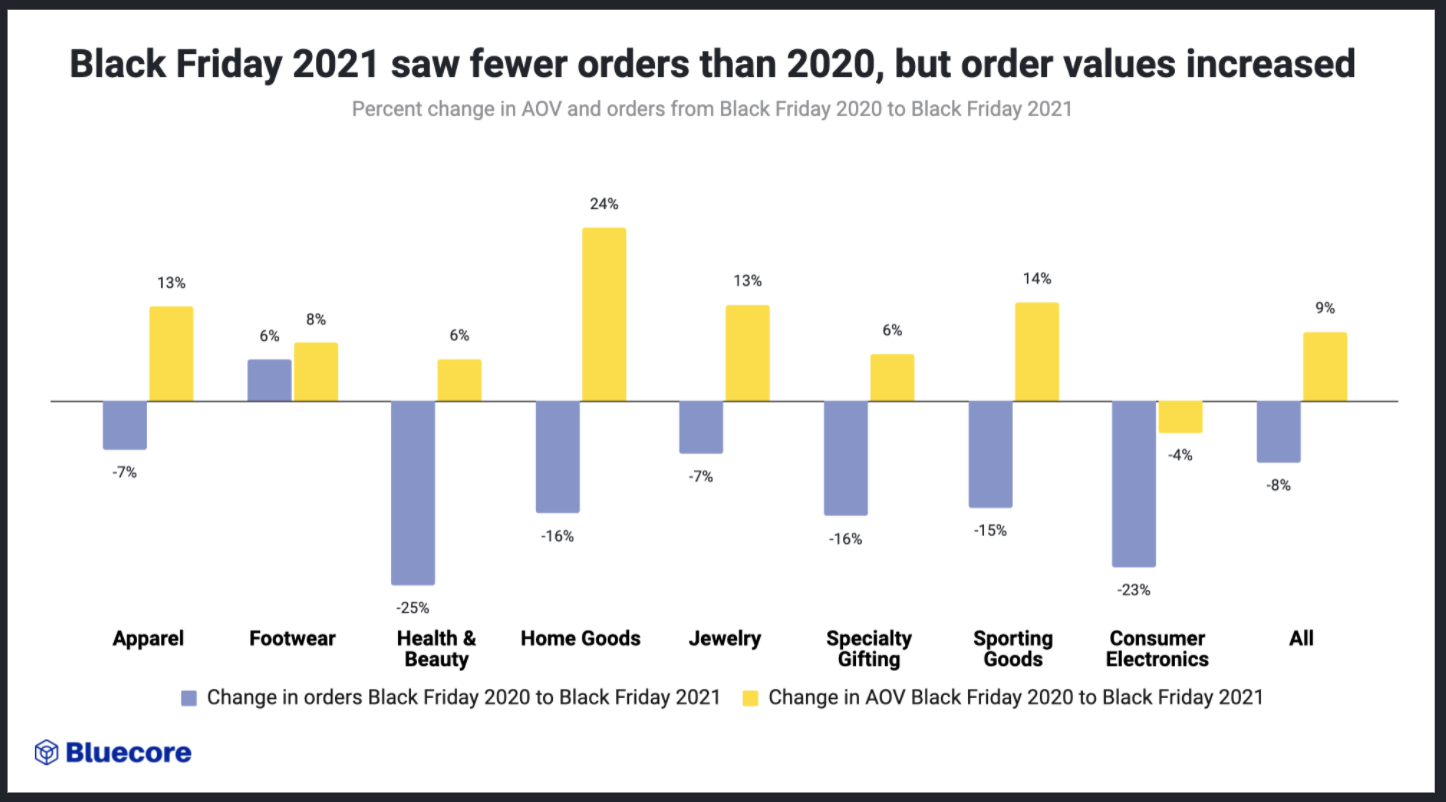

Sales are down from 2020, but average order value is up

This year saw a decrease in orders but an increase in average order value across the board (the only exception in orders was footwear with a 6% rise in orders from last year). With inflation increasing higher than it’s been in 30 years and discounting being reduced due to inventory issues, this doesn’t come as a huge surprise.

This could also indicate that brands are building larger single orders with more intelligent on-site recommendations and modals.

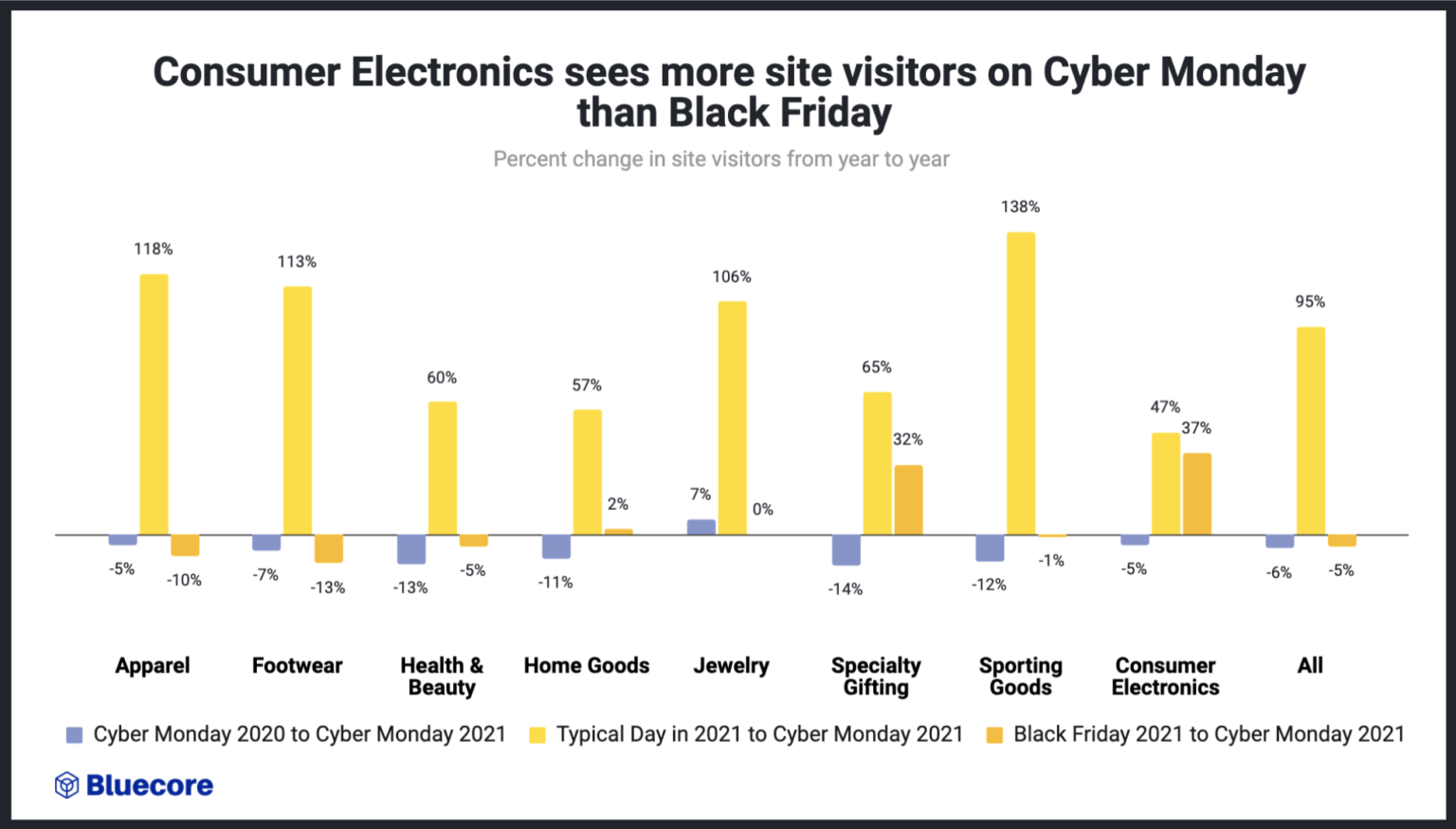

Site traffic was down 5% in 2021, but still up significantly from an average day

Black Friday site traffic decreased by 5% compared to Black Friday 2020 and 2021 Black Friday site traffic is on average 110% higher than on a typical day across verticals.

With the exception of Footwear and Jewelry, there is a slight decline in online site traffic across most verticals compared to last year, indicating that shoppers may have opted for in-store shopping since stores reopened. The 14% increase in Jewelry could represent shoppers who have considered a purchase for a while and waited until Black Friday to capture a deal.

Apparel saw the highest increase in site traffic (129%) compared to a typical day, which could indicate shoppers looking for deals to refresh their wardrobe with more opportunities to meet in person.

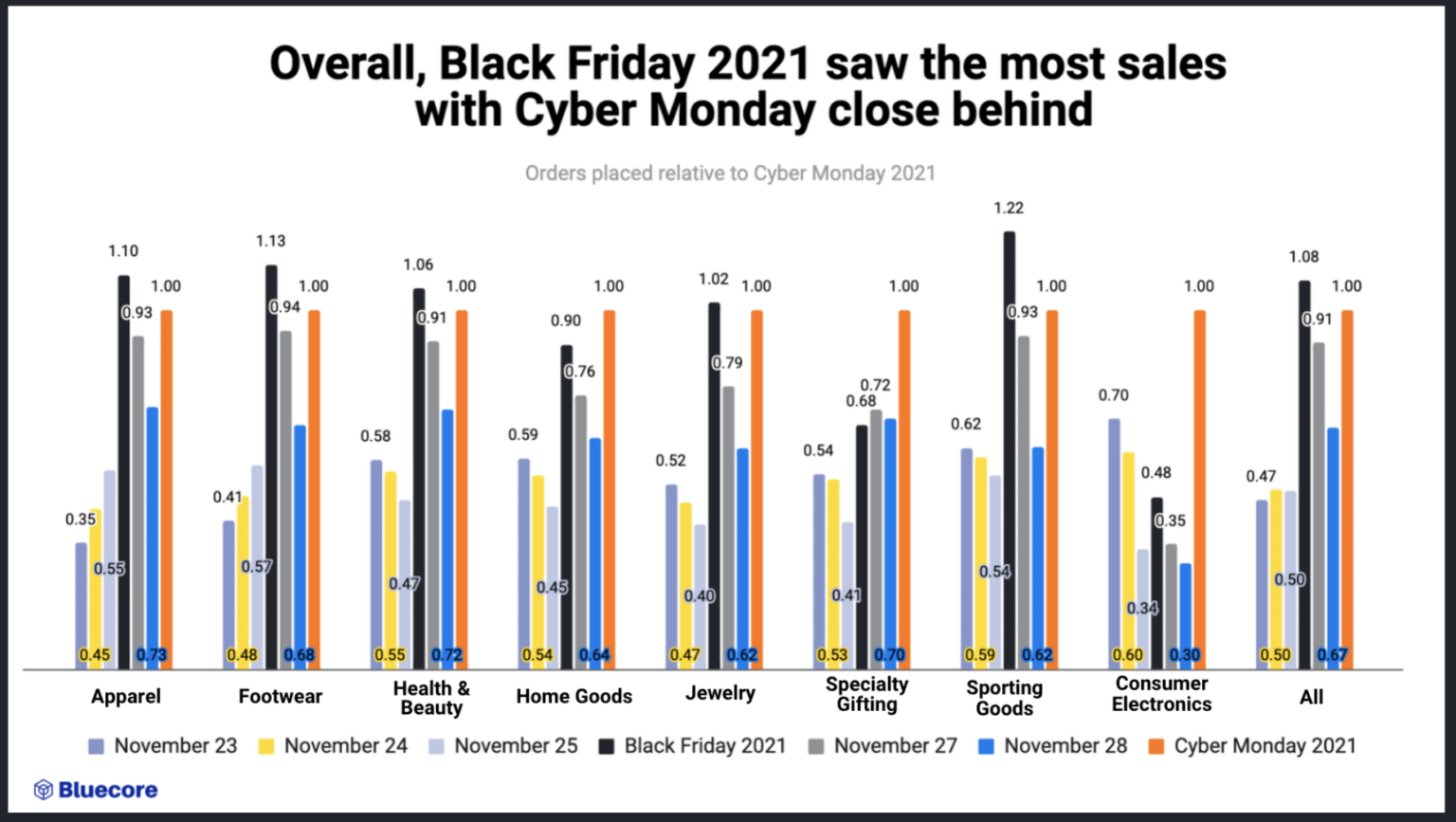

Black Friday had the most sales, followed closely by Cyber Monday

Overall, brands saw 8% more sales on Black Friday 2021 over Cyber Monday 2021.

Home Goods, Specialty Gifting and Consumer Electronics saw the most orders on Cyber Monday 2021. The Saturday after Black Friday saw steady sales across all categories.

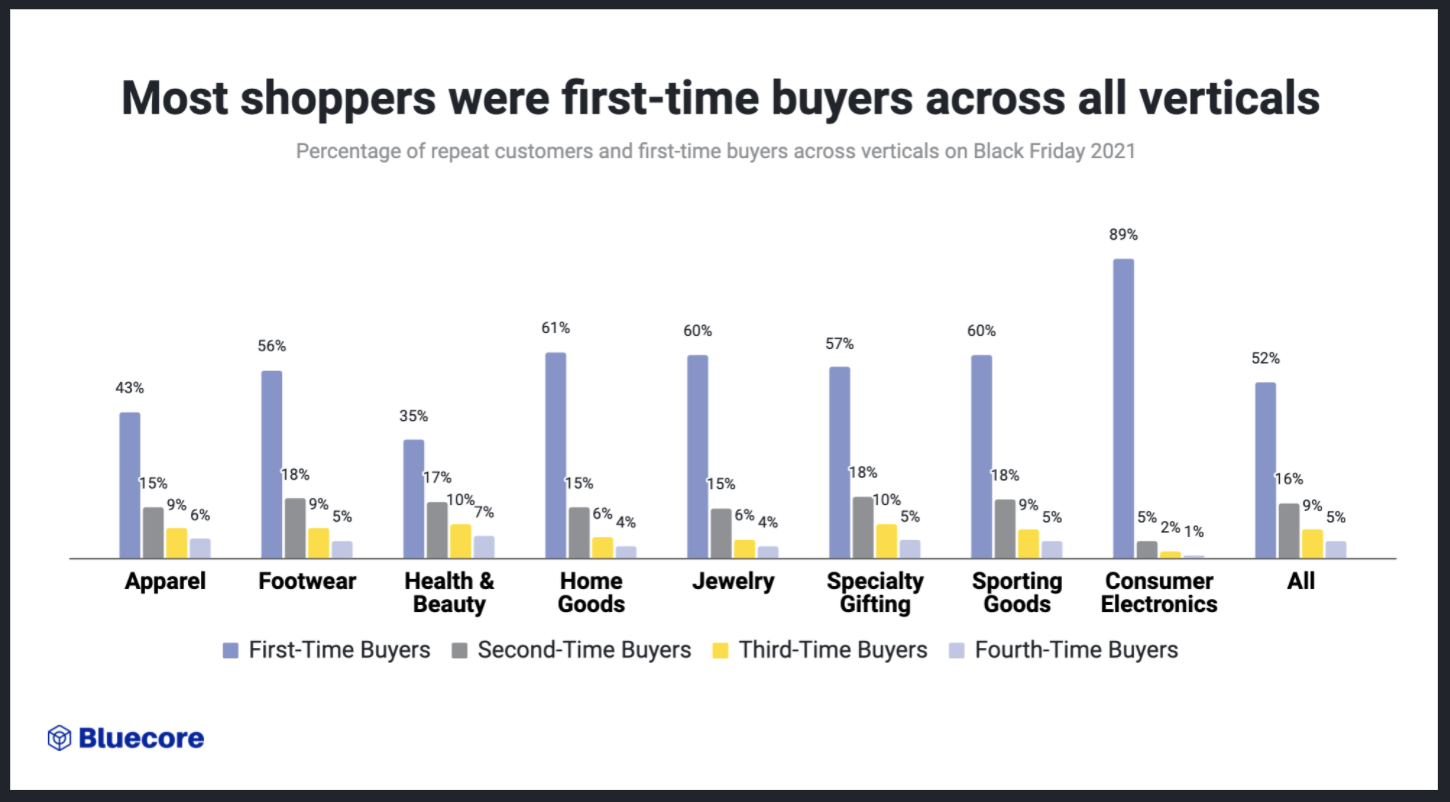

52% of shoppers were first-time buyers across verticals

Across verticals, shoppers were trying new brands for the first time — this is a typical trend for the holidays as shoppers are trying new brands with all of the discounts.

Consumer Electronics saw the highest percent of first-time buyers (89%) and lowest percentage of second, third and fourth-time buyers (5%, 2%, 1% respectively), which could indicate that many shoppers are drawn in by compelling deals for high ticket items such as TVs and don’t typically return to shop again.

The percentage of second, third and fourth-time buyers were similar across the remaining verticals.

Why is this important? These new shoppers represent a huge opportunity for brands to drive repeat purchases and increase customer lifetime value and revenue for brands. Bringing your first-time shoppers from Black Friday back to your brand could mean an $898K revenue opportunity for every 100,000 shoppers and each next purchase increases customer lifetime value for retailers across industries from apparel to home goods.

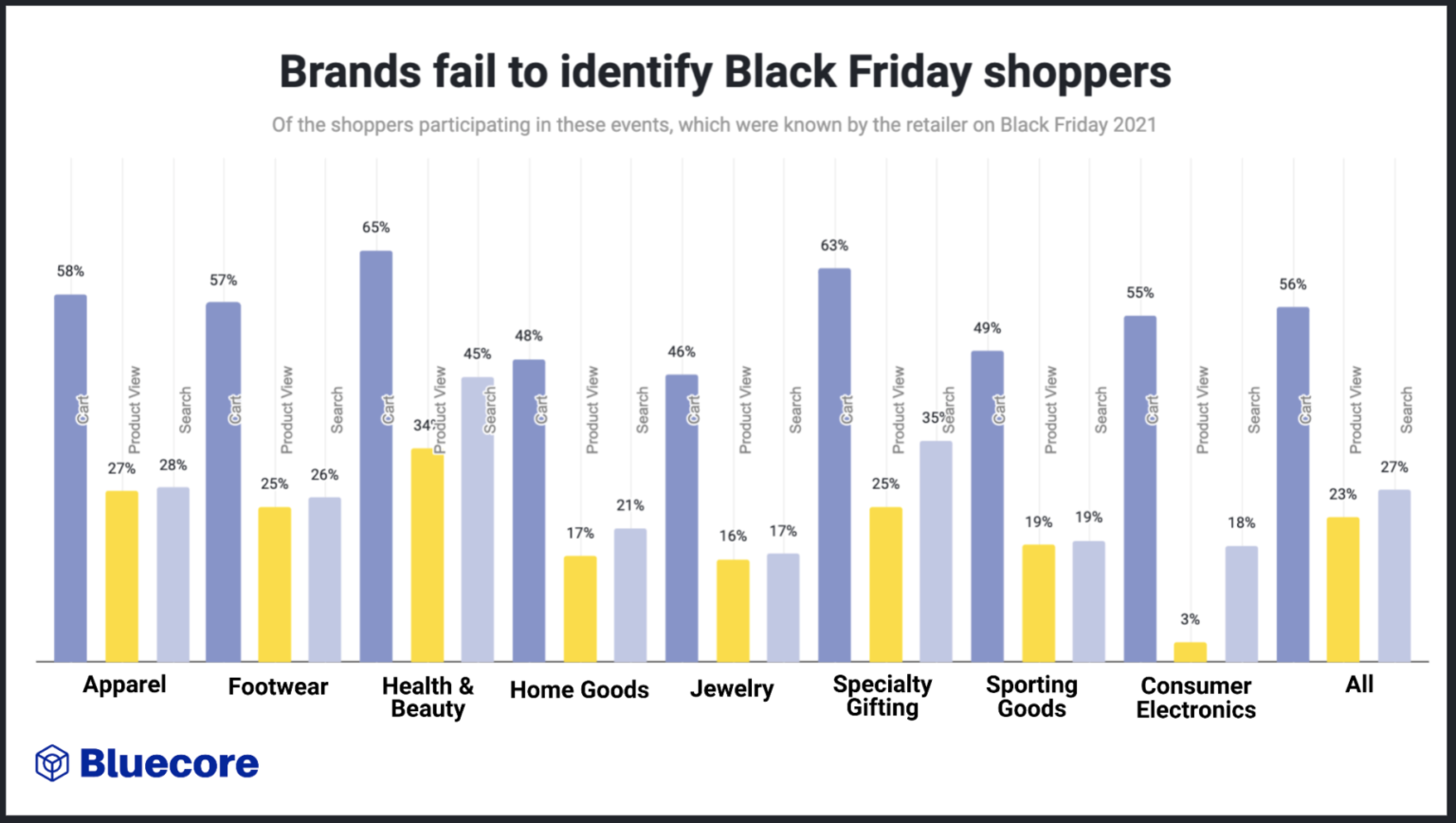

44% of shoppers who added to cart were not identified by brands

Of all shoppers who interacted with a brand’s site through adding to a cart, searching for a product or viewing a product, 43% for cart, 77% for view, 72% for search were not known for a brand. Since cart events indicate a greater intent to buy, the likelihood of identifying a shopper is higher

Health & Beauty identified the greatest percentage of shoppers adding to cart and viewing products on Black Friday 2021 (65% and 34%) and Cyber Monday 2021 (67% and 34%).

Home Goods and Consumer Electronics see the lowest percentage of identified shoppers, which could point to the occasional nature of shopping in these categories which leave less of an opportunity for shoppers to identify themselves.

Why is this important? Identifying a shopper is the critical first step in being able to communicate with shoppers effectively. Identification opens the door to understanding their unique behavior and preferences in order to be able to deliver personalized product recommendations that help shoppers navigate the variety of products on your site with as few clicks as possible and ultimately get them to their first purchase. Improved identification leads to more conversion opportunities that drive ecommerce revenue.

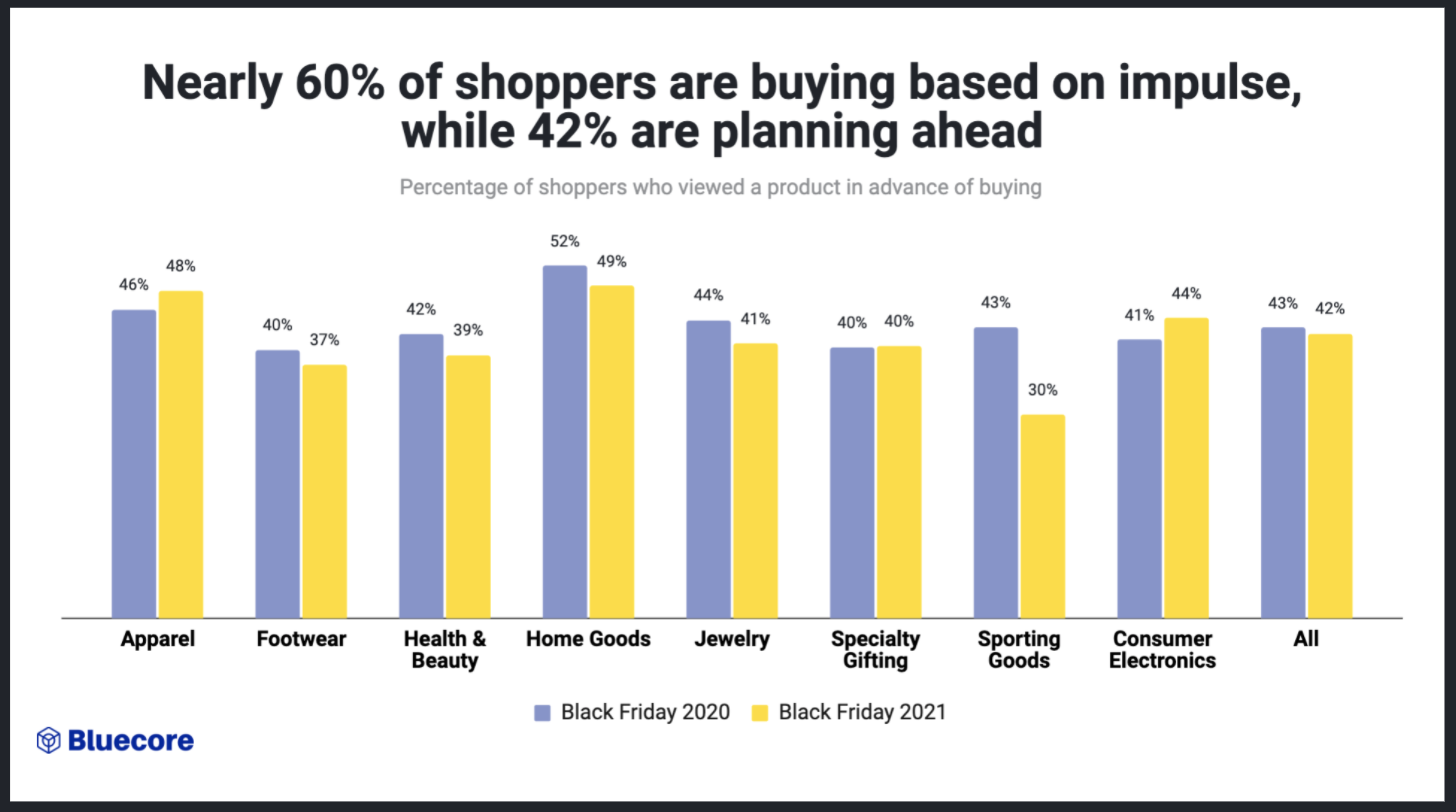

Brands have impulse buyers and planners on Black Friday Cyber Monday

The majority of purchases on Black Friday 2021 were impulse buys (58%). Most verticals saw similar thresholds of window shopping ahead of making a purchase, as they did in 2020, indicating that many purchases continue to be planned.

The decrease in window shopping in Sporting Goods (43% to 30%) could also indicate that shoppers decided to both window shop and buy the products in-store.

Why is this important? This spread of impulse vs. planned buys indicates that brands must have a marketing plan that accounts for both impulse and planned buys to capture the maximum number of purchases.

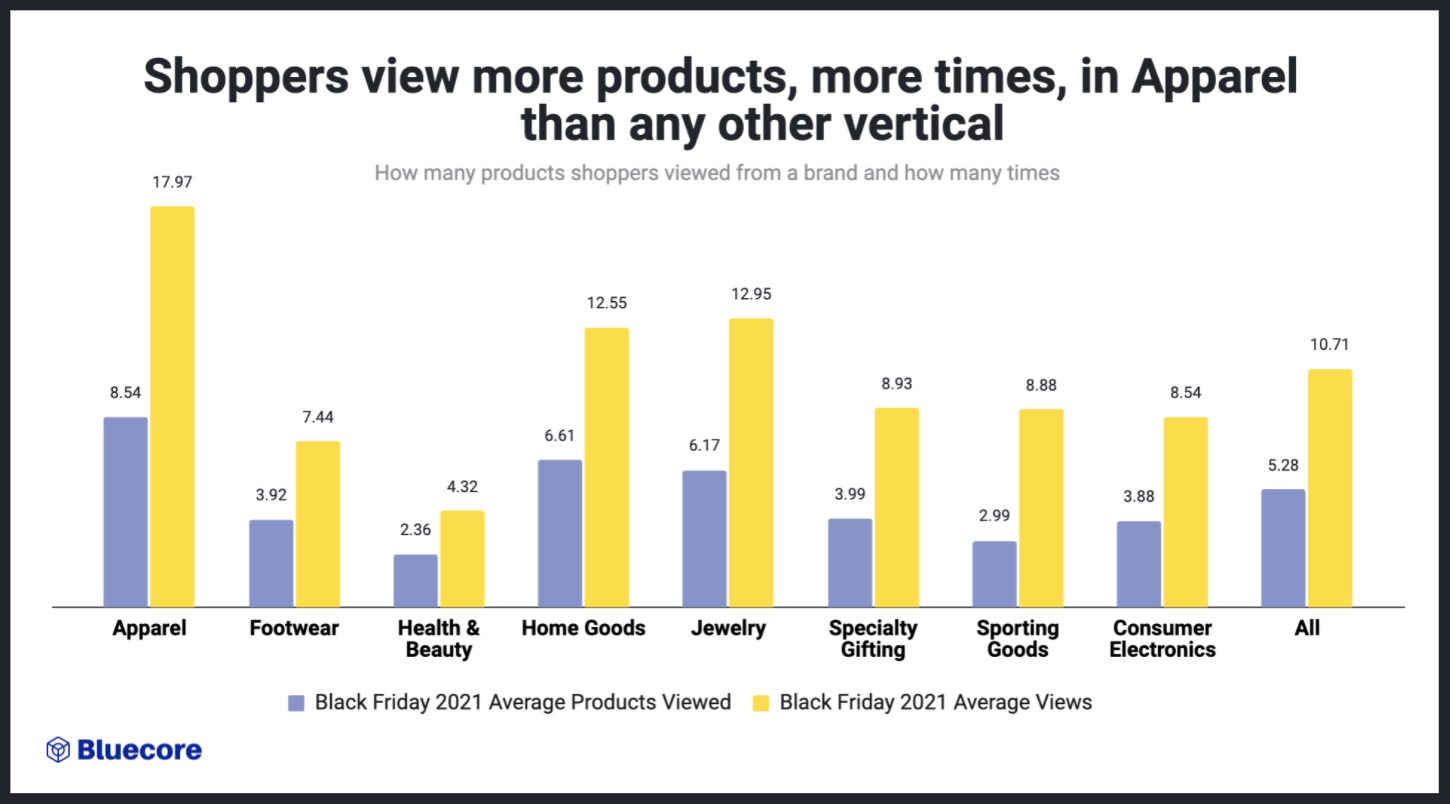

Shoppers viewed 5 products 10 times on average on Black Friday Cyber Monday

Shoppers viewed the most products the most times when shopping for Apparel (8.54 products, 17.97 times), which could indicate shoppers window shopping and browsing without a specific product in mind.

Health & Beauty, Sporting Goods and Consumer Electronics saw the lowest number of products viewed, which could indicate that shoppers had a specific product in mind.

Why is this important? Shoppers are spending a lot of time browsing. Brands can optimize their product pages and onsite experiences to increase discovery and nudge conversion with pop-up modals.

Want to get tactical?

Check out the insights with tactics you can implement to turn those insights into action.