Cutting to grow is possible

Nearly every retail marketing leader has been given the call to action to identify savings through technology consolidation. At the same time, they face ongoing pressure to grow revenue despite challenging economic conditions.

On the surface, consolidation is as easy as issuing an RFP with a list of feature requirements that enable the same workflows a retail marketing team has in place

today. While organizations that take this approach may identify cost savings, they’ll inadvertently sacrifice growth in the process. Today’s workflows are built to support marketing message volume, but this is not how marketing value is created.

Instead of developing RFPs for the sake of consolidation, the retailers that are putting themselves in the best possible position to grow despite market conditions are those that are evaluating solutions for their ability to:

-

-

- Identify browsers and buyers

- Partner in the development of customer movement strategies

- Reorient workflows to focus on generating engagement and responding to moments of intent

-

These organizations identify partners that address outcome-focused problems versus. replicating existing workflows. In the end, they are best positioned to address the blockers for generating revenue: low reach, conversion, and purchase frequency.

In the pages that follow, Bluecore’s retail strategy team outlines the questions that are critical for martech RFPs that can support both cost reduction and revenue growth. Rather than coming from tech, this team has spent their careers at Foot Locker, Champs Sporting Goods, Oriental Trading Company, Rent the Runway, Tory Burch, Target, Overstock.com, Expedia, Shop Your Way, and more.

Want help customizing your RFP based on your specific growth strategy and tech ecosystem? Get in touch with us here.

Cheers,

Jason Grunberg

CMO, Bluecore

Identify Shoppers and Customers

Identity resolution is holding marketers back from better performance

There is a near obsession with achieving the 360-degree customer view. With a single, centralized customer record, marketers believe they can achieve their dreams of perfectly orchestrated marketing across channels. CDPs are typically the system of choice, serving as the global ID or ID of record.

Identity resolution has become a key part of the process — merging data from disparate sources into the central file.

The reality is actually different from the dream. The problem is not that achieving a unified 360-degree customer profile is hard (which it is). The problem is that identity resolution actually reduces a marketer’s ability to deliver relevant marketing because of the way the process works.

A new approach called identity recognition solves for the problems caused by identity resolution, preserving more data, distinguishing important information for individual channels, and enabling faster reactions to customer behavior.

What identity resolution gets wrong

Identity resolution merges information that a marketer collects across different environments. The premise is that if a marketer can merge the data, they will get a 360-degree view of the customer, which can inform multichannel marketing.

However, merging information takes away context and real-time shopper signals. A global ID doesn’t preserve the data that’s associated with specific mobile behavior or desktop behavior. The actions someone takes on their mobile phone are different from the actions they take on their desktop. Someone might browse couches on their phone but wait until they are on their laptop to buy one, for example. But identity resolution is not architected to preserve the information needed to treat people differently on the two channels, nor is the process designed to enable retailers to respond to real-time signals. Luxury and high-consideration purchases in particular suffer from this process.

How identity recognition helps

“Identification” is a process gaining traction with retailers, which helps them recognize visitors to their website so that they can deliver more relevant messaging and experiences. Recognizing someone on a desktop or a mobile app would trigger different experiences based on the context. This requires a channel-specific ID, something that a global ID doesn’t have.

A better approach is to find a way to connect identities without eliminating channel-specific information. While many CDPs create a hierarchy with one primary ID of record, retailers really want to store customer data in such a way that there is no hierarchy. The idea is to recognize an individual, and then access data to determine what action to take — including channel-specific data.

Connecting data in a schema

To achieve this, some retailers have created a schema themselves. Brands can build a structured approach to saving data that combines customer data by channel, product data, and specific high-value events such as adding a product to a wishlist, signing up for an important newsletter, or coming in for a free offer as well as purchases. Data is saved in such a way that identities for each channel are preserved and connected, but they’re not truly “resolved” in that none of the context is lost as with traditional identity resolution.

Too many brands have weighty processes to resolve data into their CDP and then don’t know how to “unlock value” from the data. The data gets old and doesn’t do the job of driving really great marketing experiences on specific channels. What’s more, it doesn’t connect to those real- time events that are so critical in understanding a consumer’s likely next action.

Retailers don’t need to throw their CDPs away, nor do they have to rip out their channel-specific processes. CDPs work very well for what they were originally designed to do: centralize reporting and maintain data hygiene. However, retailers will see a marked lift in performance if they free their identification processes from the CDP and embrace real-time information that can drive higher performance.

Key RFP questions to evaluate identification capabilities:

-

-

- List all ways you connect a website visitor to an email address.

- Can you identify an online shopper if they are not logged in to your website?

- Are you able to do cross-device identification?

- Describe how you connect anonymous browsing behavior to a known shopper once they have been identified.

- Describe how you would identify a known visitor who returns on an unknown device.

- Detail your modal capabilities for site-based identification, the level of flexibility of these modals, and any services you provide for modal development, testing, and management.

- How do you monitor and audit identification?

- Are identification rates available in the UI? How often is this refreshed?

- Can you report on identification rates by source, channel, or tactic? Is this level of reporting available in the UI? What is the refresh rate?

- Do you offer an identification network that is part of standard implementations? Describe the network, and provide documentation on the impact your network has had on customer performance.

- Is your identification network a data co-op? Is the network SOC1 and SOC2 compliant?

- What strategies do you employ to maximize identification rates? Provide customer examples.

-

Partner in the Development of Customer Movement Strategies

Customer movement is retail’s new growth strategy

Customer movement is a marketing philosophy and framework that is centered on customers rather than channels. It’s the process of moving your customers through the sales funnel — from unidentified shopper to first-time buyer to repeat buyer to loyalist — and re-engaging those who threaten to slip through the cracks.

Customer movement embraces the fact the journey from unknown shopper to known customer to loyalist is unique for each individual. It acknowledges that customers are diverse and always moving — toward retention or churn — and the fact that brands can choose to be proactive in addressing and shaping this movement. To help do this, a customer movement strategy elevates the metrics that provide insight into customer performance — retention and reactivation, purchase frequency, average order value, and customer lifetime value — in order to achieve quarterly revenue goals, annual growth, and profitability. This long-term view into customer performance is essential to developing strategies to address negative trends – e.g., low retention of new buyers, year-over-year declines in acquisition – and over-invest in positive ones like increasing sales per buyer as cohorts age and improvements in second-year retention.

Bluecore’s data shows that leaders who prioritize customer movement strategies are driving massive changes in their businesses. While any customer can increase the top line, only retained customers drive profit. And our research shows that these leaders who focus on customer-led growth are increasing the contribution margin from their retained customers by 4x to 12x.

This concentration on customers allows brands to use their resources more wisely. A customer movement strategy positions brands to experiment to discover the best ways to drive profitable growth, and then prioritize the implementation of the most promising tactics. For one brand, customer movement may offer the ability to stop offering across-the-board discounts. Instead offer customers a personalized incentive to increase average order value — or, if those customers would purchase without one, none at all. Another retailer may use customer movement to more actively engage with the middle of their customer file. Still, others may find that the insights from customer movement can boost their efforts to acquire new customers. In each case, customer movement provides enormous short-term value while laying the groundwork for long-term, profitable growth.

These results don’t come from another tool or channel tactic. They’re the outcome of incremental shifts in the way you understand your file health and your customer base, and the way you set your goals.

When you think about file health: Do you have an acquisition problem or a retention problem? Both? Neither? How does that change your budget for both acquisition and retention?

When you think about your customer base: Do they have a high value? What is their average order value, orders per buyer, tenure, and retention rate?

While we tend to place a lot of emphasis on order value, retention has the biggest impact on profitability. Because frequency and retention are inseparable, it’s important to focus on retention to drive profit. Frequency is a leading indication of retention — more important than average order value.

When you set goals: How granular are they? Are you focused on retaining customers with a high average order value? Optimizing subscriber-to-buyer conversion rates based on affinities? Targeting the acquisition of predicted high-value customers? Reactivating former replenishment customers?

Leading retailers are building customer-centric strategies aimed at improving specific levers in customer value. When placing customer value at the center of strategic planning, everything from media, to creative, to merchandise supports the overall goal of creating profitable growth through customer value.

A customer movement analysis illustrates an uncomfortable fact of retail life. New customers are not immediately profitable. They pay back their cost of acquisition over time. Profitability comes after a customer is acquired and purchases a second, third, and fourth time. The quality of the customer determines the rate of return on the investment needed to acquire them.

That’s why it’s critical to know how long it takes a customer to recoup their acquisition costs. That payback time, in effect, helps the marketing team work with the CFO, illustrating that an investment in new customer acquisition is likely to be repaid at a certain rate within a certain time period.

This same information also helps set the range for how many net new shoppers you need in one year and how many of them you need to retain. It will allow you to determine how many customers are needed in different frequency ranges — how many two-time customers, three-time customers, etc. With a focus on customer movement, you’ll also be able to see the blends of different customer cohorts that will be required to hit your numbers. And your channel experts can start developing ideas to help attain these improvements. With a healthy list of tactics, the next step is to estimate the impact of each one, and then prioritize them by their potential impact and the effort required to execute on each.

Key RFP questions to evaluate customer movement capabilities:

-

-

- Describe how you would personalize messaging to unknown shoppers before they’re identified.

- Describe how your platform can convert an unknown website visitor to a one-time shopper and a one-time shopper to a repeat buyer.

- Describe how a marketer could activate campaigns on your platform to drive the following outcomes:

- Reducing one-and-done rate

- Reactivating at-risk customers before they churn

- Identifying and leveraging customers’ inflection points of engagement to improve CLV

- Describe how your platform can help me understand customer-level metrics so that I can better redirect my acquisition, retention, and coupon spend.

- Describe how your platform activates campaigns based on time series analyses and strategies devised on those analyses.

- How would you identify opportunities and assist us in capitalizing on strengths and mitigating weaknesses in our customer relationships?

- How would you prioritize these competing opportunities (capitalizing on strengths and mitigating weaknesses in our customer relationships)?

- How does your platform enable us to address these opportunities (capitalizing on strengths and mitigating weaknesses in our customer relationships)?

- How would you measure and report on the results of the efforts to capitalize on strengths and mitigate weaknesses in our customer relationships?

- Describe your organization’s philosophy on the relationship between batch campaigns and triggered campaigns. Demonstrate how your product roadmap reflects this philosophy.

- Provide three case studies from customers relevant to our business with documented evidence on the ability to increase repeat purchases, describing the before and after for the circumstances.

- Detail the strategic services you offer related to customer movement and which of these are included in baseline pricing versus what are additional or ad hoc fees.

-

Reorient Workflows to Focus on Generating Engagement and Responding to Moments of Intent

Shifting from pushing product to moving customers

While identification and customer movement are essential to increasing reach and establishing a specific growth strategy at the customer level, a retailer needs to have the right approach to messaging to get consumers over the line.

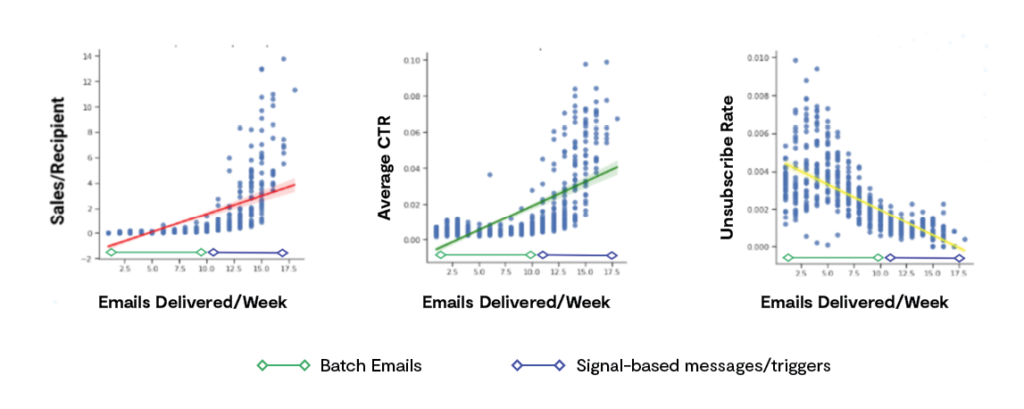

The idea that increasing marketing volume increases the revenue value produced by a marketing organization is false. Bluecore’s analysis of hundreds of retail brands demonstrates little to no positive net impact of sending a large volume of batch messages. Sales per recipient do not meaningfully increase; however, unsubscribes do. Retailers are decimating their files and the potential to cheaply market to these individuals moving forward.

Triggered messaging performs significantly better because they are inherently based on shopper signals at the moments of interest or intent. The more triggers delivered, the more sales are generated, the more customers click through, and the less they unsubscribe.

Triggered campaigns can produce 400% more revenue and 18x more profit than batch campaigns. Yet the vast majority of retailers continue to view batch messaging as a means for increasing revenue. The perspective on batch should shift to understand it as a means for driving traffic to site and then leveraging triggers for recapturing abandoned sessions, serving as the catalyst for new shopping-centric sessions, and re-engaging lapsed buyers. As a result, the volume of customers a retailer moves and the revenue they generate is transformed.

The retailers that have evolved their workflows to spend more time developing, testing, and delivering triggered messaging are those that are increasing customer movement and growing channel revenue at a time when many retailers are citing year-over-year performance declines for the channel.

Retailers require hundreds of triggers

A true understanding of a shopper means that a retailer needs to decipher shopper preferences across every facet of their interactions with that brand. One study found that 73% of online consumers expect companies to understand their unique needs, up from 66% two years earlier. The concept of “understanding unique needs” goes beyond simple personalization that takes into account generally available demographics or recent purchases.

Meeting shoppers’ unique needs also requires a more granular use of product data such as sizes, colors, categories, what’s new in stock, what’s selling fast, if prices change, whether there are coordinating items, etc. To really get to the heart of those “unique needs,” retailers are starting to realize that product data can be an equal player in their personalization strategy — but only if the data is real-time and tied to the context of each individual shopper’s preferences.

While many marketers are already personalizing triggered marketing based on consumer behavior, they will often blast product info to everyone. Holiday discounts are a classic example. But even broadcast messages can and should be tailored.

By marrying information like new arrivals, new prices, and back-in-stock data with shopper data, retailers unlock a wide range of triggers to launch.

Magic happens when a shopper’s behavior aligns perfectly with information about a product. Think of a shopper who browsed an expensive vase for six weeks anda retailer emails as soon as the price drops, triggering a purchase. These are the moments that deliver those great customer experiences and make shoppers feel like a retailer understands their needs.

To create retail marketing that really gets at that concept, retailers need to better understand the important consumer behaviors and all of the important product attributes that can be aligned to create that feeling of customer understanding. By categorizing these based on the customer lifecycle, a retailer can begin to build out the entire tactical mix needed to address customers where they are in the journey with the messaging designed to match.

Each node on the globe above represents the universe of signals or use-cases a retailer should action on — with multiple variations possible for each customer segment, acquisition source, product margin, and more. By focusing time on launching new triggers and changing the approach to batch messaging to drive engagement over simply promoting products, retailers will be in a position to grow.

Key RFP questions to evaluate ability to engage and capture moments of intent:

-

-

- Please describe how your system would integrate our product catalog with customer records and online behavior. Please highlight any customizations required to your standard data model to support this. Once set up, does this happen in real-time?

- Please describe whether your system has the ability to auto-predict customer behaviors such as lifetime value, lifecycle stage, and product preferences. Please specify other predictive attributes the system is able to auto-generate and explain how these outputs are utilized by end-users of your system.

- Does your platform support personalization based on loyalty status and tiers?

- Please list the standard triggered journeys your system supports and the high-level steps to set them up in your platform.

- Please explain how your company defines dynamic content vs. 1:1 content personalization and how each is configured within your system.

- Are we able to control email frequency to recipients through your application automatically? Please describe how frequency capping and prioritization is managed.

- Does your system support a hierarchy of triggered emails potentially deploying around the same time with prioritization so that an email address qualifying for multiple emails in the hierarchy will only receive one? Please provide details on how you would support these needs.

- Describe the process of setting up a Notify Me trigger for products that are out-of-stock. Is your system able to support the use case where there is an explicit opt-in as well the use case where qualifying for the trigger is inferred based on product availability combined with customer online behavior (i.e., not requiring the opt-in)? Are you able to send the Notify Me alerts based on SKU level (i.e., “the green size 5 is back in stock”)?

- Describe the process of setting up a Price Drop trigger for an audience that has engaged with similar product category SKUs in the last 15 days. Are you able to send the price drop alerts at a SKU level (i.e., “the green size 5 is on sale”)?

- Describe the specific product recommendation logic within your platform and what is required to set up that functionality. Describe how a marketer can curate or refine product recommendations for a specific campaign (for example, co-view recommendations but only within the boot category).

- If your system has the ability to support cross-channel activation beyond triggered email, please list those channels and describe how your product’s audiences and personalization capabilities extend into these other channels.

- Describe your engagement and deliverability feedback loop management process. How is this utilized to optimize future interactions for engagement?

- What is the maximum number of attributes allowed for each customer record and the flexibility of the data file layout? Can data fields/attributes be added and changed easily?

-

Looking for additional resources to support your RFP?

Check out guidance from Gena Colts, Randi Gladstone, and Bradford Johnson, from our Customer Success and Retail Strategy teams here or request a consultation here.

Bluecore’s retail shopper identification and customer movement technology quickly generates incremental revenue for enterprise brands by turning more anonymous shoppers into known customers, and repeatedly and efficiently moving them through the purchase funnel.

With transparent IDs and real-time product data built directly into campaign workflows, alongside point-and-click predictive models, retail marketers can bypass manual processes to trigger 100s of communications based on any signal and automate the content, offer, recommendation, timing of every email, mobile, site, and paid media message for each individual shopper.

More than 400 brands trust Bluecore to rapidly increase customer retention and drive profitable growth, including Express, NOBULL, Lenovo, Teleflora, Alo Yoga, and Lulu and Georgia.